60 Minutes' Intel CEO interview breaks down the chip shortage and global dependency on Asia

Intel's CEO exposes just how fragile a supply chain can be.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

What you need to know

- Intel CEO Pat Gelsinger recently went on the CBS show 60 Minutes.

- During the show's interview, he stated the U.S. had seen a drastic dropoff in semiconductor production.

- It's reiterated that Intel is the last domestic line of defense for U.S.-based semiconductor needs.

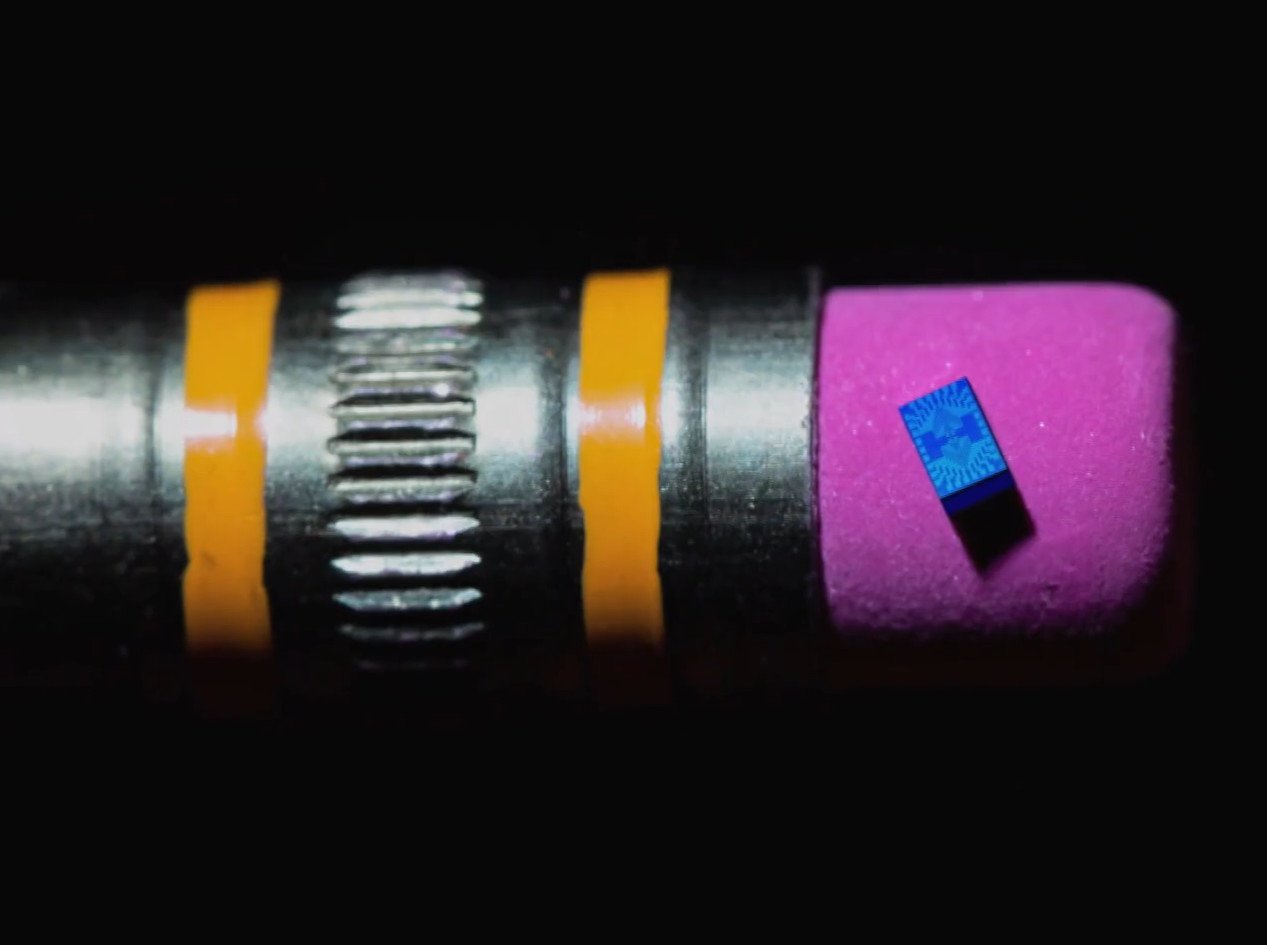

Though there were many takeaways from Intel CEO Pat Gelsinger's time on 60 Minutes, including the announcement that Intel will be spending big money on Rio Rancho fab facility upgrades in addition to its $20 billion plan to make new fabs in Arizona, the biggest might be the sobering words Gelsinger shared regarding the state of the United States' semiconductor dependency.

After viewers were informed that there used to be twenty-five chip manufacturers globally and now there are only three, with Intel being the only U.S.-based one, Gelsinger then gave a stat that goes a long way toward explaining why the country's in the shortage rut that it's in.

"25 years ago, the United States produced 37% of the world's semiconductor manufacturing in the U.S.," Gelsinger said. "Today, that number has declined to just 12%."

For comparison, 75% of semiconductor manufacturing currently happens in Asia.

Gelsinger went on to say that reliance on any single region, especially one such as the ever-unpredictable Asia, is a risky strategy. He added that Intel's goal is to bring some of that dependency back home so that domestic chip output is better equipped to handle the needs of the U.S. citizenry, in addition to benefits like creating U.S. jobs. By bringing production home, the U.S. will be in control of its technological future.

When TSMC's outpacing of Intel in the manufacturing sector was brought up, Gelsinger had an optimistic take: "We believe it's gonna take us a couple of years and we will be caught up."

Time will tell if Intel can live up to that goal, catch up to TSMC, and help protect the U.S. from future chip shortages as dire as the current one.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Robert Carnevale was formerly a News Editor for Windows Central. He's a big fan of Kinect (it lives on in his heart), Sonic the Hedgehog, and the legendary intersection of those two titans, Sonic Free Riders. He is the author of Cold War 2395.