Here's why NFTs may be the next era of licensing technology

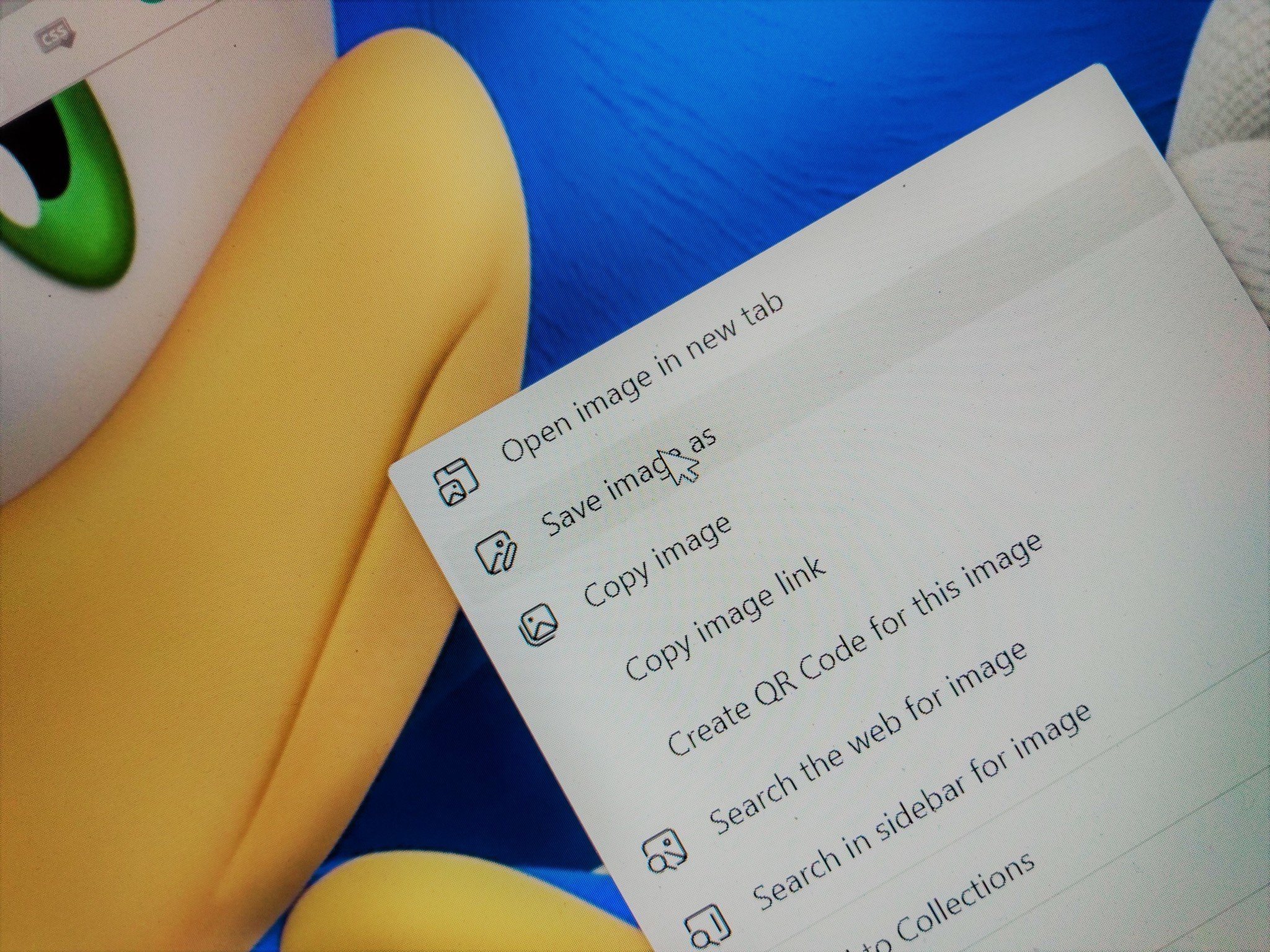

If you right-click an NFT, is it still an NFT?

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

Non-fungible tokens. NFTs. What are they? Tokens that represent digital ownership. Proof that you own something. But much like any piece of digital content on the internet, what stops "ownership" from being trivialized when someone right-clicks your goods?

These are the non-fungible questions Windows Central sought to answer with the insights of experts. Spoiler: There's more to this topic than some might have you believe.

Not so different

We already pay for .jpg files and the like. Getty Images and Shutterstock embody the same basic philosophy as NFTs: Any company that doesn't want to risk getting sued pays up for the mere right to use a few kilobytes of imagery. Small-timers who aren't big enough to be sued just right-click and move on.

Anshel Sag, a senior analyst at Moor Insights & Strategy, agreed that there's a similarity between existing licensing models and what we've seen of NFTs thus far. However, he noted distinct attributes of the emerging tech.

"I think the big difference is that having these transactions on the blockchain makes them easier to track and verify once the transaction has occurred, and the original creator doesn't need to keep a local record of all transactions to verify ownership and authenticity," he said.

More than meets the eye

It's not just convenience that puts NFTs in their own category, though. There are aspects of the tech that can uniquely benefit creators. "For example, many of these image license firms don't really fully reward the original creator for the total earnings that the licensing entity can make from an image," Sag stated. "A small creator would need to negotiate (and be in the position to negotiate) a certain rate with the licensing entity rather than simply setting their own terms on an open marketplace and allow anyone who wishes to purchase their creation to do so under the terms of the smart contract."

Sag also highlighted that images are the tip of the iceberg and shouldn't define NFT tech. Non-fungible tokens aren't a right-click-wins-all situation, since it's harder to copy a 3D asset or specific audio file. In other words, depending on what's being sold, theft may not be easy to commit.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Gartner Distinguished VP Analyst Avivah Litan brought up similar points to Sag, reiterating that NFTs come in a variety of forms and grant creators unique capabilities that classic licensing models don't often afford. Similarly, Litan noted that if one wants proper ownership of an NFT, the blockchain-based contract is essential (ergo, right-clicking is a no-go for big businesses that need to operate by the books). However, the onus still falls on the creator to sue if their property is stolen, much like how existing digital content services have to manually go after parties using their works without permission.

The intersection of environment and economy

Beyond the aforementioned topics, one other big question hangs over NFTs: Are they harmful to the environment, and if so, how harmful?

"Bitcoin cannot support NFTs since they are essentially smart contracts and Bitcoin does not natively support smart contracts," Litan stated. "On the other hand, Ethereum does support the vast majority of NFTs. Ethereum is moving to using the Proof of Stake consensus algorithm this year (2022) which uses modest amounts of energy, so the entire energy argument against NFTs will be moot. Further, other blockchains that support NFTs (for example Solana and Ronin) do not use Proof of Work but use Proof of Stake or Proof of Authority instead."

Right now, Bitcoin and Ethereum use the Proof of Work model, which is the energy-hogging algorithm causing much of the ruckus around NFTs. As Litan highlights, non-fungible tokens will soon be exempt from this particular conversation once Ethereum hops ship. There are many resources available if you want to learn more about Solana and blockchain tech in general.

"NFTs are far less energy consuming than cryptocurrencies, but there are some connections in the sense that some of these NFTs rely on crypto blockchains like ETH for their transactions, which ties them to the energy consumption discussion," Sag stated, before highlighting alternative options for those concerned about the environmental impact of their actions. "Moving blockchains to Proof of Stake from Proof of Work is another way to save on energy consumption. Palm is a very popular blockchain for NFTs and claims a 99.9% energy savings over Proof of Work-based blockchains alleviating concerns about NFTs consuming too much power on the back of cryptocurrencies like Ethereum."

If Palm sounds familiar, recall that Microsoft's M12 recently helped out Palm NFT Studio in the funding department. In other words: Some big parties are paying attention to Palm.

The NFT debate, in summary

To boil down the non-fungible quagmire to its core NFTs aren't entirely defined by easily copied images. They are, in a lot of ways, the evolution of existing licensing services that major corporations already play ball with, but made of new tech and armed with more potential creator benefits.

While the sillier NFT projects are attracting ire for good reason, the tech as a whole is still in its infancy. Time will tell whether they replace existing services used for similar functions.

As outlined in Gartner's 2021 Hype Cycle for Emerging Technologies report, "NFTs have yet to demonstrate lasting business models and monetization for content creators, sellers and buyers, meaning that adoption is currently low." The full realization of this technology has yet to come, and fresh obstacles for creators and buyers are still emerging. But underneath that is a core concept that could, in time, be useful to the future of digital ownership.

Robert Carnevale was formerly a News Editor for Windows Central. He's a big fan of Kinect (it lives on in his heart), Sonic the Hedgehog, and the legendary intersection of those two titans, Sonic Free Riders. He is the author of Cold War 2395.