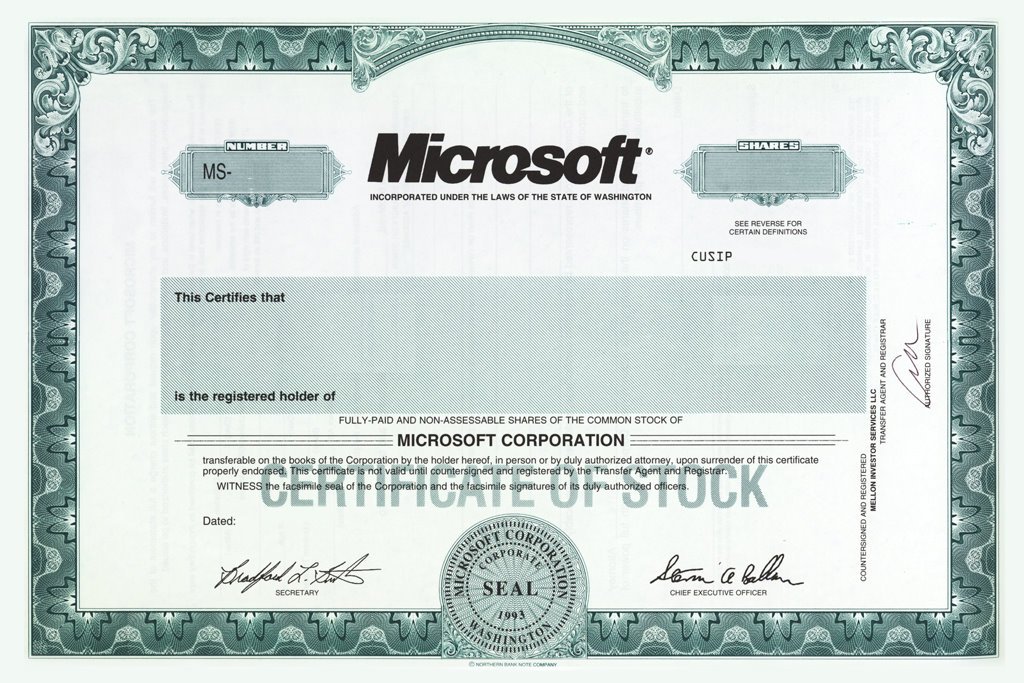

Microsoft not fairing well on Wall Street

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

Even though Microsoft appears to be on the cusp of a revolution of consumer devices e.g. Windows Phone 7 and Xbox Kinect, Wall Street seems to be having cold feet when it comes to recommended them for investment.

Seeking Alpha is reporting that just this month FBR, Goldman, Janney Capital, Pacific Crest and Barclays have all issued a 'cut' for Microsoft. Most of this has to do with the news of PC sales leveling off this last quarter, which seems to be negating the other news of Windows 7 being the fastest selling OS in history.

Not all is bad though, as the feeling on Wall Street seems to be that MS is just performing flat for awhile, though we'll see what they have to say come Thursday when they report their earnings.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Daniel Rubino is the Editor-in-Chief of Windows Central. He is also the head reviewer, podcast co-host, and lead analyst. He has been covering Microsoft since 2007, when this site was called WMExperts (and later Windows Phone Central). His interests include Windows, laptops, next-gen computing, and wearable tech. He has reviewed laptops for over 10 years and is particularly fond of Qualcomm processors, new form factors, and thin-and-light PCs. Before all this tech stuff, he worked on a Ph.D. in linguistics studying brain and syntax, performed polysomnographs in NYC, and was a motion-picture operator for 17 years.