Microsoft is on track to become the second $4 trillion company by market cap, following NVIDIA — and mass layoffs

Microsoft's share price rose over 19% this year so far, vastly outperforming the overall market.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

NVIDIA might have clinched the world-first $4 trillion crown, but Microsoft could be hot on its heels.

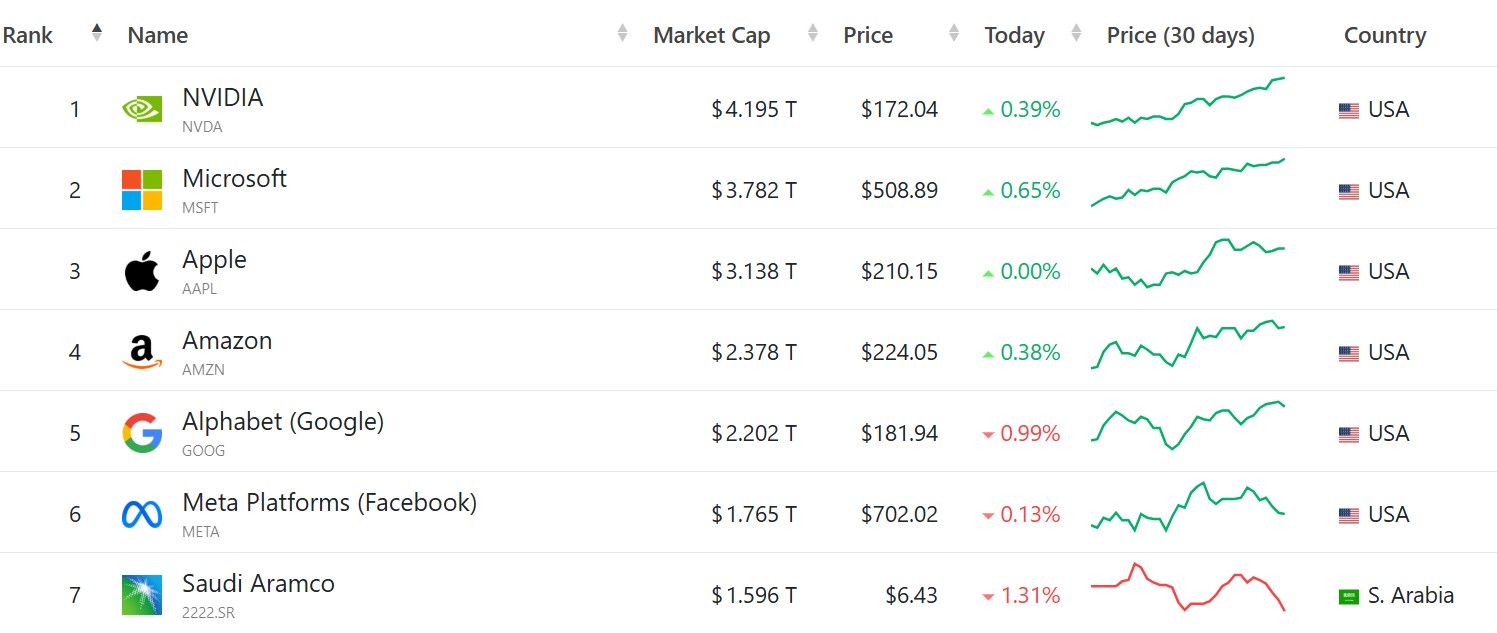

As stock performance goes, Microsoft under CEO Satya Nadella has been a shining star, for better or worse. Microsoft's market capitalization as of writing is $3.758 trillion, putting it just shy of NVIDIA's $4.179 trillion. Microsoft has comfortably began to outpace Apple, at $3.1 trillion, as investors get nervous about Apple's position (or lack thereof) in a world increasingly dominated by AI.

Indeed, NVIDIA and Microsoft's market position in recent times has been driven by cloud services. NVIDIA providing the hardware, and Microsoft providing the software, in essence. NVIDIA's server technology is powering the global artificial intelligence goldrush. Microsoft's Azure data center operations, in combination with its OpenAI partnership, is powering the back end for hundreds of thousands of Azure customer — and millions of their customers by extension. Indeed, Apple itself is reportedly leveraging Azure and OpenAI's models to power some of its platform features, showing the virtue of Satya Nadella's big cloud investment strategy.

Microsoft's share price has risen by over 15% this year as of writing, which has beaten the S&P 500 index by a comfortable amount.

Microsoft's stock has become a hot ticket in recent years owing to big dividend payouts and stock buyback programs. Those who invested back at the start of the cloud goldrush have made mountains of profits with Microsoft stock, and that looks set to continue as cloud underpins practically every new technological leap. Without cloud, there's no AI, there's no Netflix, no Amazon, no web services, apps, online games, and so on — and its this that has driven Microsoft to market capitalization dominance in recent years.

Microsoft has also invested heavily in subscription-based services, such as Microsoft 365, Azure platforms, and even Xbox Game Pass — giving it reliable and steady revenue that outperforms retail trends and provides resilience against consumer confidence, to a degree.

But there's still risk factors involved. Some analysts regard Microsoft stock as overly expensive right now, which is probably partially why Microsoft has had so many layoffs this past year.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Boosting margins and increasing profits-per-employee is a short-term way to grow into its valuation, but as I wrote last week, the chilling effect its layoffs has on employee morale and product quality could do long-term harm. Windows, Xbox, Surface, and other consumer-facing Microsoft products have stagnated in some ways, some more than others — leaving the diversification of Microsoft's business vulnerable.

One has to wonder just how much of Microsoft's current strategy revolves around boosting the stock price, given exec pay packets are often tied to stock, rather than actually providing high-quality products. You'd think the stock price would go hand in hand with high-quality products, but many of Microsoft's existing offerings, particularly in the consumer segment, leave a lot to be desired.

Its enviable second place position in cloud isn't guaranteed either, as Google and others rapidly invest in catching up. Google also doesn't need to rely on OpenAI for its AI models either, potentially giving it an advantage when it comes to innovating new products. There's also been jitters that agentic AI, that is, AI that can basically fully replace humans, might paradoxically impact some of Microsoft's enterprise software businesses.

Microsoft has shown itself to be adaptable and versatile when navigating new technological paradigms, but this rapid shifting of priorities has often been viewed as presenting inconsistent and unreliable to consumers. Microsoft's business to business operations remain its core strength, regardless, and it's likely this fact that will drive its market capitalization above $4 trillion in the coming weeks or months ahead.

But things can change rapidly in tech, even for big players like Microsoft.

Jez Corden is the Executive Editor at Windows Central, focusing primarily on all things Xbox and gaming. Jez is known for breaking exclusive news and analysis as relates to the Microsoft ecosystem — while being powered by tea. Follow on X.com/JezCorden and tune in to the XB2 Podcast, all about, you guessed it, Xbox!

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.