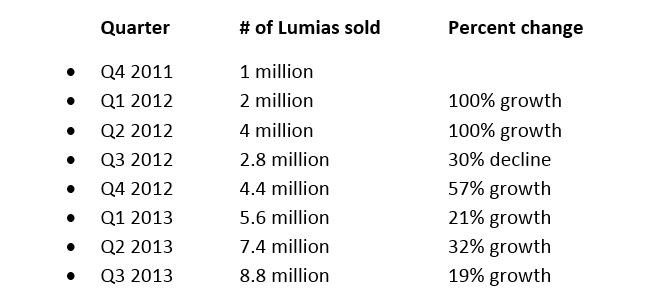

Nokia Lumia sales up a mild 19% quarter-on-quarter to 8.8 million units in Q3

Nokia's Q3 results show slight but steady Lumia growth

This morning, Nokia posted their Q3 results, detailing how well their Lumia line has been doing in addition to their other services. The bad news is overall, the company was flat quarter-on-quarter, with HERE sales down 9% due to seasonal variation. Likewise, NSN was also down 7%, again attributed to “seasonality”.

The good news though is regards to Nokia’s mobile phones, which includes Asha and Lumia. Generally, Q3 volumes were up 4% quarter-on-quarter to 55.8 million units, “demonstrating solid performance across the majority” of Nokia’s range of devices.

More specifically, Lumia Q3 volumes improved by 19% quarter-on-quarter to 8.8 million units, mostly attributed to the Lumia 520. While the percentage of growth overall is lower than the previous quarter (7.4 M at 32% growth), Nokia is still chipping away at the smartphone market:

As exemplified above, sales of Lumia devices have been steadily increasing since their inception in November 2011 with the Lumia 800. However, it looks like Lumia sales are overall either slowing down or not picking up much speed when compared to Android or iPhone sales. At this rate, it will take quite a few years for Microsoft to make significant inroads into the smartphone race.

Nokia also sells more Lumias (8.8 million) than Asha devices (5.9 million) with “normal” inventory range (4-6 weeks), meaning they are managing sales well without Lumias collecting dust on shelves.

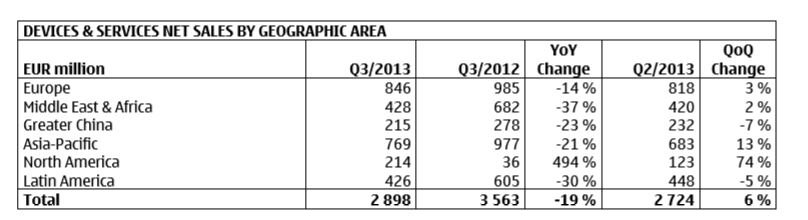

Sales being driven by North America?

Broken down by region, we can see that in North America (Canada, United States and Mexico), year-over-year change is an impressive 494% for net sales.

Device volume is also update 367% for the same region, with all other areas, including Europe, Middle East & Africa, Greater China, Asia-Pacific and Latin America actually down year-over-year.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Microsoft / Nokia deal won’t devalue

Due to the Q3 results and projections for Q4, Nokia does not expect there to be a purchase price adjustment in the Microsoft acquisition. The EUR 5.44 billion amount will stand.

The deal is still expected to close in 2014. Interestingly, the division that Microsoft is buying (Devices and Services) from Nokia, accounted for 50% of Nokia’s net sales in 2012.

Nokia, the company that is left after the Microsoft deal, will focus on three areas:

- NSN – Network infrastructure

- HERE – Mapping technology

- Advanced Technologies – “which will build on several of Nokia's current CTO and intellectual property rights activities”

That last area is perhaps the most interesting as we could see the company still release new hardware, just not smartphones.

The picture for Nokia for Q3 appears to be not great, but not terrible either. In hindsight, the Microsoft deal does look to have been the right decision if only because these numbers don’t represent the kind of growth Nokia would need to remain sustainable in the long run.

We’ll have more on Nokia’s numbers throughout the day.

Source: Nokia (PDF)

Daniel Rubino is the Editor-in-Chief of Windows Central. He is also the head reviewer, podcast co-host, and lead analyst. He has been covering Microsoft since 2007, when this site was called WMExperts (and later Windows Phone Central). His interests include Windows, laptops, next-gen computing, and wearable tech. He has reviewed laptops for over 10 years and is particularly fond of Qualcomm processors, new form factors, and thin-and-light PCs. Before all this tech stuff, he worked on a Ph.D. in linguistics studying brain and syntax, performed polysomnographs in NYC, and was a motion-picture operator for 17 years.