What to think about Nokia after yesterday’s 16% stock price collapse

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

Yesterday, Nokia CEO Stephen Elop took the stage to unveil two important new Lumia phones powered by Microsoft’s new Windows Phone 8 OS. Despite positive reviews of the hardware, the stock collapsed by 16%.

What does all this mean? Why did the stock collapse and what does it mean for the future of Nokia and Windows Phone? Is there a real message here, or is this simply panic and depression on the part of investors?

Let’s start by looking at what Nokia actually announced. Two new Lumia phones, the 920 and 820, will hit the market in Q4. All the attention was on the 920 because Nokia needed to prove it can come up with a high end smartphone. To their credit, Nokia delivered the goods. It’s jam packed with an amazing display, PureView camera and other industry leading specs.

That said, it looks to me like Nokia botched the presentation by allowing Wall Street to feel uncertain about so many important things. Where exactly will the device be released? We don’t know anything more than “select markets”. What carriers have agreed to carry it? Sorry. Don’t know. What’s it gonna cost? Oh. Nokia didn’t say. On top of this, the general consensus is that Nokia’s executive team just didn’t deliver a compelling presentation.

Elop stood on stage talking about how Nokia is “doing work” on important areas such as radio performance, battery life, blah, blah blah. I’m sorry Steve, but when you waste time talking about vague research ideas in front of an audience hungry for new products, you lose them. People stop caring.

In short, Nokia is to blame for the 16% stock price drop yesterday. Yes, they delivered great new products. But they failed to alleviate the uncertainty Wall Street investors worry about.

Looking at Nokia stock out longer term

I’ve seen my share of stocks tank as an equity analyst over the last decade. Quite often, huge stock movements are driven by emotion. I think yesterday’s crash by Nokia fits that description perfectly. Wall Street hates uncertainty, and yesterday’s announcement only told us what we already know: Nokia can make good phones.

All the latest news, reviews, and guides for Windows and Xbox diehards.

We still don’t know much about the future success of Windows Phone as a mobile ecosystem, what kind of support game and app developers will show towards Microsoft (and hence Nokia). We don’t know what Microsoft’s true plans are to compete with its hardware partners (remember they’re making their own tablet?)

And Nokia still has a revenue base that comes almost entirely from what I call “dumb phones”. Symbian is on a path towards zero. It’s not like this legacy OS will die tomorrow, but ask yourself if we’ll still see Symbian phones in 10 years. I don’t think so.

Nokia has to shift from a company that sells about a million non-Windows phones per day into a success built upon Microsoft. Either they succeed at this, or they have very little future.

I think yesterday’s announcements were pretty solid. In the long term, I think they suggest that Nokia has a slightly better chance, rather than what the market implies through the 16% stock price drop. But remember that Wall Street is driven by short term emotional thinking. In the long term, Nokia is a story that lives or dies based upon Microsoft’s success in mobile.

A quick look at Nokia fundamentals

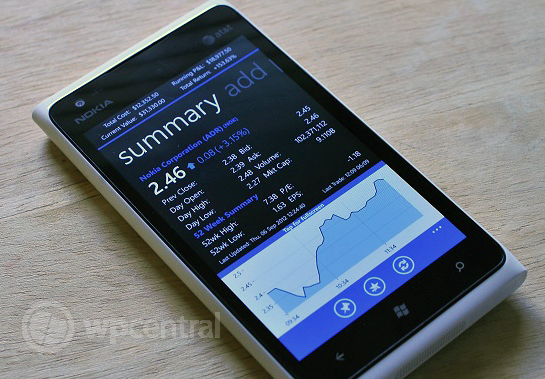

Nokia brought in $42.5 billion in revenue over the last four quarters. They are losing money right now, but through cost cutting (restructuring), they hope to get back to profitability. The entire company is worth $9 billion based on its current stock price of about $2.44 (as I write this) but the enterprise value (adding in debt, subtracting cash) is only $3.2 billion. In other words, Wall Street values Nokia’s actual business as being worth $3.2 billion.

With a stock price of $2.44 and a book value of $3.54 per share, you’d think Nokia might be undervalued, right? Not necessarily. A large chunk of this book value comes from intangible assets such as goodwill, which is generated when one company acquires another at a price higher than its own book value. This is very common, and happened when Nokia bought Navteq for $8.1 billion. But for purposes of valuing a stock, goodwill isn’t actually worth anything. I think of it as a dummy asset required to balance the books.

All things considered, Nokia isn’t necessarily a bargain. They have built up a huge organization and they’re going through incredible change. This will continue for many years. They’ll either continue to be relevant in the new world of smartphones, or they won’t.

If you believe in Microsoft and Windows Phone 8, yesterday’s crash should come as welcome news. It gives you a chance to buy Nokia for less. But if you are skeptical of Nokia’s ability to stay relevant, or Microsoft’s ability to be a big player in mobile, then it doesn’t matter how far Nokia’s stock drops. You don’t want to touch it.

(Chris Umiastowski is a contributing writer to the Mobile Nation network. You can see the rest of his posts here at AndroidCentral, iMore and CrackBerry.)

Chris is an analyst and Former Contributor for Windows Central.