ARM wants NVIDIA and Intel as investors ahead of its IPO

ARM wants NVIDIA and Intel as its anchor investors ahead of its IPO.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

What you need to know

- ARM is reportedly negotiating with Intel and NVIDIA to get them as anchor investors ahead of its IPO.

- The company intends to raise approximately $10 million later this year by publicly listing its shares.

- NVIDIA previously tried to acquire ARM, but the deal was terminated because of significant regulatory challenges.

According to Financial Times and Bloomberg reports, chip giant Arm is reportedly in talks with rival makers Intel and NVIDIA to get them on board as anchor investors ahead of its IPO at the New York Stock Exchange, which is scheduled for later this year. (via Tom's Hardware)

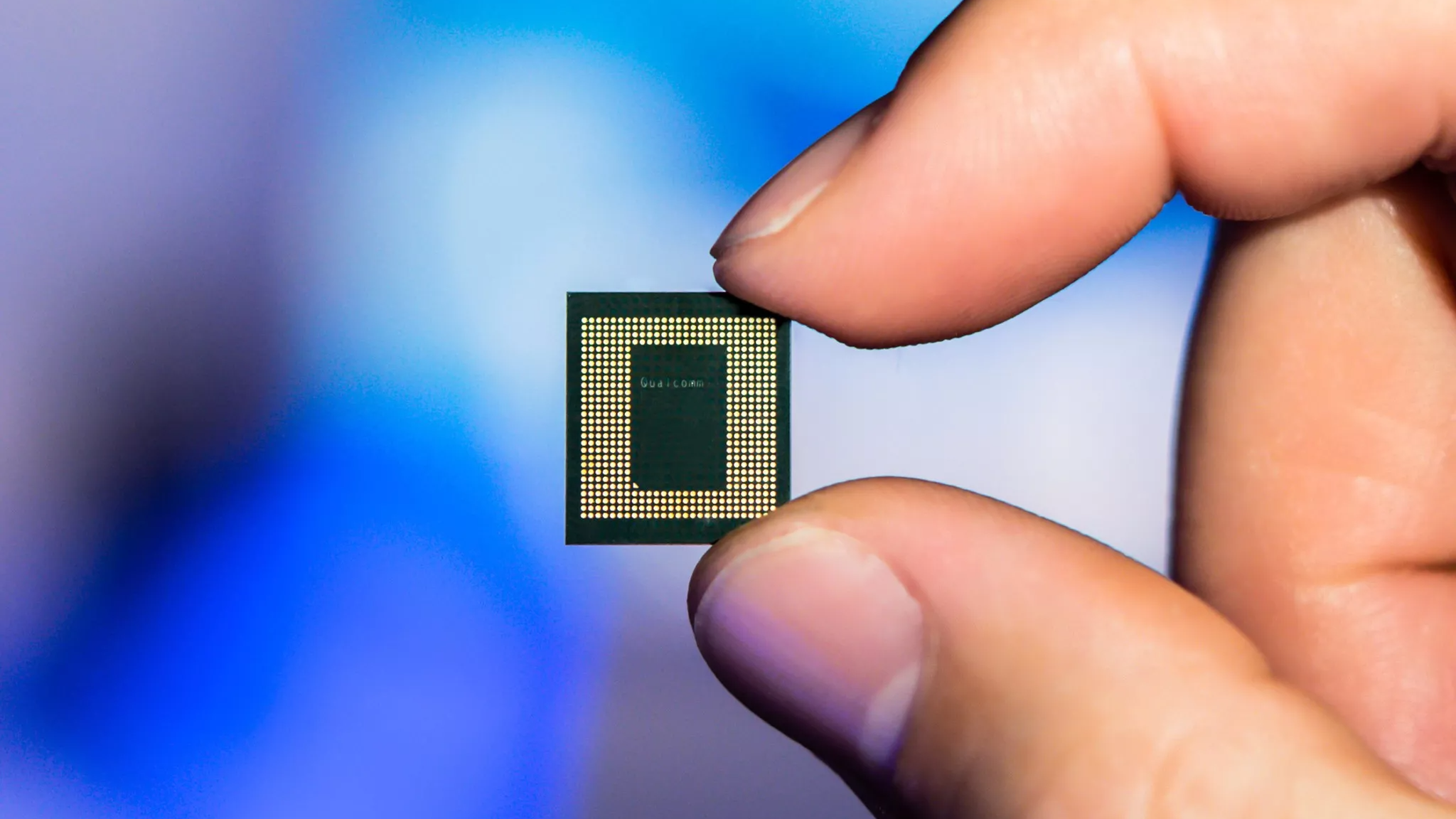

If the Japan SoftBank Group firm can secure both companies as investors, this affirms the success of its forthcoming IPO. ARM majorly focuses on the development of silicon chips and the setting of license instructions used to determine how chips function. Key industry players like Apple, Samsung, and many others leverage ARM's intellectual property, such as Reduced Instruction Set Computing (RISC), for the chips incorporated in their own technology.

NVIDIA attempted to acquire ARM for $40 billion early last year, but the deal was terminated after both companies reached an agreement following significant regulatory challenges. There was also a growing concern over access to Arm's IP for competitors, which prompted U.S. and European regulators to block the deal.

And while negotiations are ongoing between ARM and interested parties, sources familiar with the deal have indicated that NVIDIA has shown interest in a share price between $35 billion and $40 billion. This translates to the ARM'S overall value. But at the same time, ARM's goals are significantly higher at an estimated $80 billion.

ARM intends to raise a whopping $10 billion later this year by publicly listing its shares. Keeping this in mind, with key industry players as anchor investors, ARM stands a better chance as a new listing in the market.

SoftBank's head, Masayoshi Son, has been at the forefront, trying to get anchor investors onboard to boost ARM's revenue ahead of the IPO. Financial Times has cited that ARM and Intel have already contacted regulatory bodies in the US to address potential challenges that might arise from the pending investment.

To this end, none of the parties involved have commented on the matter, but we'll keep a close eye on the story as it unfolds and keep you updated.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Kevin Okemwa is a seasoned tech journalist based in Nairobi, Kenya with lots of experience covering the latest trends and developments in the industry at Windows Central. With a passion for innovation and a keen eye for detail, he has written for leading publications such as OnMSFT, MakeUseOf, and Windows Report, providing insightful analysis and breaking news on everything revolving around the Microsoft ecosystem. While AFK and not busy following the ever-emerging trends in tech, you can find him exploring the world or listening to music.