Missed Microsoft's conference call on the acquisition of Nokia? Get the summary right here

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

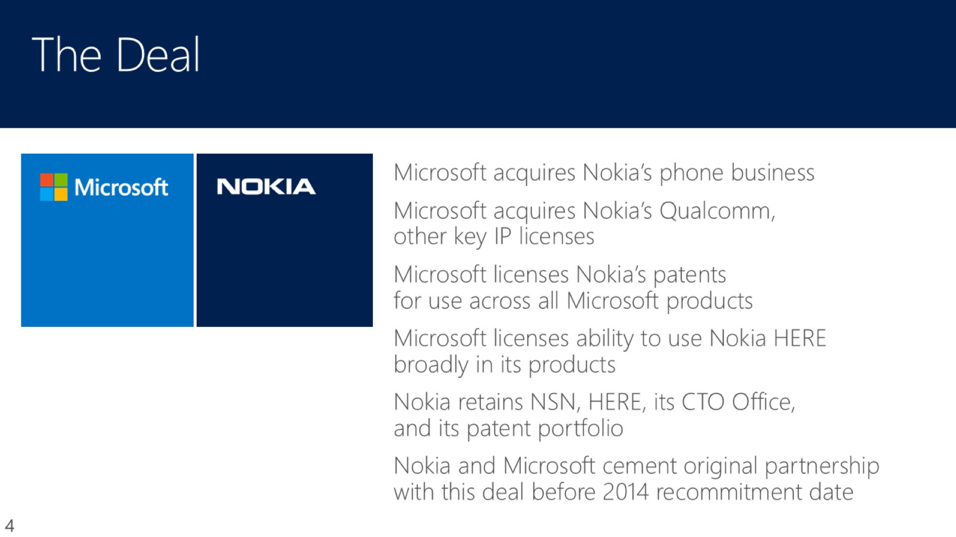

Earlier today Microsoft held a conference call for investors, analysts and the press to discuss its acquisition of Nokia's devices business. The audio only call followed a very tight structure around slides that had earlier been revealed to show some of the specifics of the deal.

If you missed that call don't panic as there wasn't a whole lot of new information, and you'll pick up everything important in the slides which you should be able to download at this link Edit: looks like that link has been pulled by Microsoft so here's a backup on Skydrive (app users remember to swipe right and tap the "View Links" button). Said presentation was then followed by a Q&A which we've done our best to capture in writing which you'll find after the break.

Apart from the information in those slides and the Q&A below, it was interesting to hear Stephen Elop acknowledge the emotions of Nokia's current employees as they will be transitioned to new roles in the expanded devices group at Nokia. Also on the call were of course Steve Ballmer, Amy Hood, Terry Myerson, Brad Smith and Chris Suh. Not surprisingly all were very enthusiastic about the acquisition and keen to demonstrate a confidence in the regulatory process and shareholder approval, as well as consumer acceptance.

Please note that the following Q&A notes were taken live during the call then cleaned up prior to posting. Therefore they should not be considered as direct quotes from any of the individuals concerned:

Q&A:

Q: Concerning Tablets, much of this presentation is rationale for phones, how does the transaction impact the tablet strategy?

A: Myerson: Certainly a continuum. Fair to say that our customers are expecting us to offer great tablets and we'll be pursuing a strategy along those lines.

Ballmer: Have our own hardware and have strong programs with our OEMs which I think people will get a lot of value from

All the latest news, reviews, and guides for Windows and Xbox diehards.

Q: Question for Steve Ballmer, how does this affect the reorganisation given the hardware / content device structure at present?

A: Ballmer: Still intact, this will expand the devices group and Julie will continue to run the existing group. But the critical mass will increase with Elop running phones. Then the two will integrate figuring that out. In response to a follow up question regarding current OEM's share of the Windows Phone market: I don't see the percentage of OEM phones compared to 80% of devices from Nokia changing in the near future. But with us leading the way and driving volume, we expect Windows Phone to be more attractive.

Q: Nokia has 33,000 employees where Microsoft has over 90,000 how will this personnel integration work out?

A: Ballmer: In many hardware companies there is outsourcing...

Hood: 18,000 of the 32,000 are directly part of manufacturing, they are part of the new vision. Outside of that will be different, sales force will remain as we know. Other jobs are dependent on looking at integration

Q: What does the acquisition enable you to do that the partnership couldn't? Or is it more about solidifying MS's presence?

A: Ballmer: 1 brand, looks better than the "Nokia Lumia Windows Phone 1020" which has been confusing for consumers. A range of improvements can come which will be simplifying how we work with operators. On Innovation, there's always some areas where we can't innovate with the current partnership. For instance more services and software could have been invested in that awesome Lumia 1020 camera. Finally there is some financial inefficiency with the current arrangement so by being one company we gain agility.

Q: You have assumed a 15% share in the marketplace in 2015, to get there you're going to need a lot of developer support (already iOS, Android and HTML5), how do you plan on achieving that support?

A: Myerson: Developers today Windows offers an incredible opportunity (PCs, Tablets, Xbox One, Phones) you can already use HTML5 for some of those platforms. We're excited about the platforms we're bringing to market, and we know we have a lot more work to do.

Ballmer: Driving volume, the key is offering first party applications and awesome first party hardware to increase the market share volume and bring developers on board once that volume has been achieved. HTML5 takes away a little bit of the apps barrier to entry and we’re aware of that.

Q: Was ValueAct made aware of this proposition?

A: Smith: No you would not expect the company to disclose that information, the answer is no.

Jay is a Former Contributor for Windows Central.