Microsoft FY22 Q2 earnings: $51.7 billion in revenue, beating predictions [Updated]

Once again, Microsoft flexes its monetary muscle.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

What you need to know

- Microsoft has released its FY22 Q2 earnings report.

- The company achieved a haul of $51.7 billion in revenue, a 20% year-over-year (YoY) increase.

- Once again, Microsoft Cloud proves to be a financial winner with $22.1 billion in revenue, representing a 32% YoY jump.

Update January 25, 2022, at 6:25 p.m. ET: Comments from Microsoft's FY22 Q2 earnings call have been added to the end of this report.

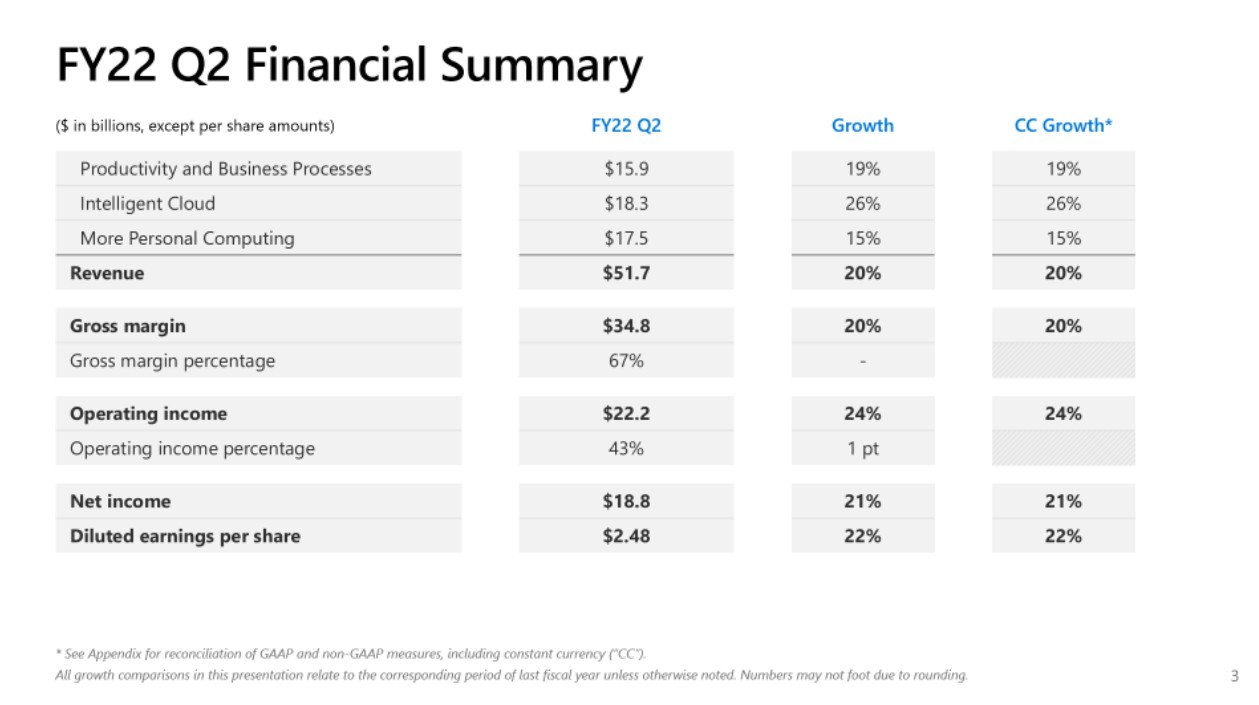

Microsoft's FY22 Q2 (fiscal year 2022, quarter two) results are in, and, as has become the usual for the tech giant, it made an extraordinarily large sum of money in its latest quarter. It accrued $51.7 billion in revenue, beating out Wall Street estimates for the umpteenth quarter in a row. Here are the big takeaways from the FY22 Q2 report:

- Revenue was $51.7 billion and increased 20%

- Operating income was $22.2 billion and increased 24%

- Net income was $18.8 billion and increased 21%

- Diluted earnings per share was $2.48 and increased 22%

"Solid commercial execution, represented by strong bookings growth driven by long-term Azure commitments, increased Microsoft Cloud revenue to $22.1 billion, up 32% year over year," said EVP and CFO of Microsoft Amy Hood, reiterating just how vital Azure is to Microsoft's overall strategy.

Cloud, productivity, and computing gains

Productivity and Business Processes revenue stayed strong with a 19% YoY jump made possible by $15.9 billion in revenue. Individual operations that combined to achieve the aforementioned total include:

- Office Commercial products and cloud services revenue increased 14% driven by Office 365 Commercial revenue growth of 19%

- Office Consumer products and cloud services revenue increased 15% and Microsoft 365 Consumer subscribers grew to 56.4 million

- LinkedIn revenue increased 37% (up 36% in constant currency)

- Dynamics products and cloud services revenue increased 29% driven by Dynamics 365 revenue growth of 45% (up 44% in constant currency)

LinkedIn continues to do well despite some troublesome news in October 2021, overcoming obstacles and maintaining growth.

Intelligent Cloud operations brought in $18.3 billion in revenue, a 26% YoY increase. Within that space, cloud services and server products revenue shot up by 29% thanks to Azure.

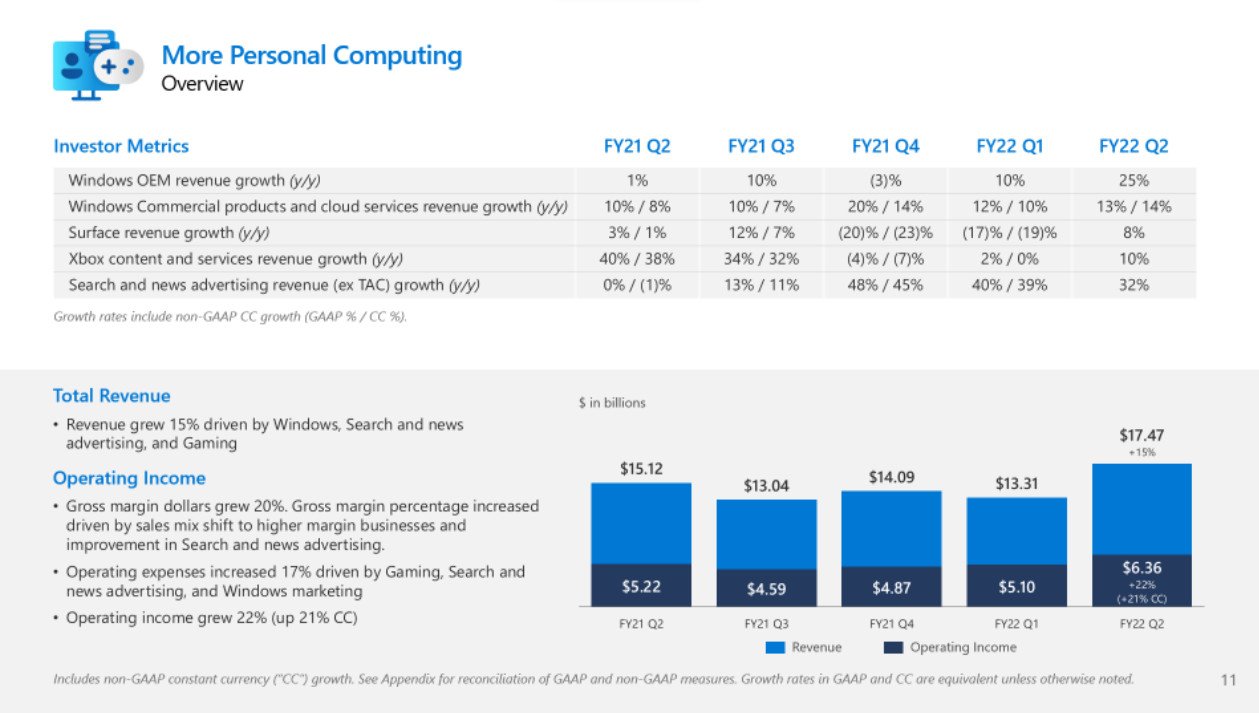

More Personal Computing also saw growth to the tune of 15% YoY with $17.5 billion. These were the big gains from that sector:

All the latest news, reviews, and guides for Windows and Xbox diehards.

- Windows OEM revenue increased 25%

- Windows Commercial products and cloud services revenue increased 13% (up 14% in constant currency)

- Xbox content and services revenue increased 10%

- Search and news advertising revenue excluding traffic acquisition costs increased 32%

- Surface revenue increased 8%

As the above figures indicate, Surface and Windows both enjoyed particularly strong figures. Similarly, Xbox content and services saw a healthy 10% uptick, though games specifically grew by 8%. First-party titles and Game Pass were, as expected, key pillars of the growth.

To put this quarter's gains in context, Microsoft managed to beat out not only Wall Street's bets, but also its own expectations as outlined during its FY22 Q1 earnings call. You can see the full FY22 Q2 report via Microsoft's press release and accompanying slideshow, which detail more specifics for each individual earnings category.

What's next

After Microsoft releases its quarterly report, it holds an investor call, so stay tuned for that. You can listen to it live at 2:30 p.m. PT / 5:30 p.m. ET via the company's investor portal. It's not always chock-full of information that's useful to the common tech enthusiast, but once in a while a gold nugget will drop that's not in the earnings report, be it a detail about the state of Xbox operations or an interesting Microsoft Teams figure. If you want to know everything you can about the company's trajectory and forecasts, you'll want to attend the call.

Post-call news

Update: The call has taken place. Here are the key remarks discussed regarding existing milestones and forward-looking statements for FY22 Q3.

Over 90% of Fortune 500 companies use Microsoft Teams, including Walmart which has chosen Teams for its small army of over two million workers. More than 1.4 billion PCs are running on Windows 10 and Windows 11, and Edge market share has grown. Edge has empowered $800 million in savings via its coupons. Microsoft's Nuance acquisition is expected to close in Q3.

As for forward-looking figures, another strong quarter is expected in FY22 Q3. Consumer growth is anticipated to be in the high single digits, Dynamics growth is guesstimated to be somewhere in the mid-twenties (percent) range, and Azure revenue growth should be up sequentially. $15.6-15.85 billion in revenue is expected for productivity business, while Intelligent Cloud is estimated to bring in $18.75-19 billion, driven by Azure. Surface growth is forecast for the "mid-teens," while Windows OEM growth is expected to land in the high single digits. Gaming revenue should grow in the mid-single digits, and consoles will continue to be impacted by supply chain uncertainty (that means Xbox Series X).

Robert Carnevale was formerly a News Editor for Windows Central. He's a big fan of Kinect (it lives on in his heart), Sonic the Hedgehog, and the legendary intersection of those two titans, Sonic Free Riders. He is the author of Cold War 2395.