Microsoft FY22 Q1 earnings: $45.3 billion in revenue, surpassing forecasts

Microsoft's fiscal year 2022 is off to the races.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

What you need to know

- Microsoft has reported its FY22 Q1 earnings.

- The company managed $45.3 billion in revenue, a 22% year-over-year (YoY) increase.

- Microsoft Cloud produced $20.7 billion in revenue this past quarter.

Update October 26, 2021, at 6:25 p.m. ET: Comments from Microsoft's FY22 Q1 earnings call have been added to the end of this report.

Microsoft's FY22 Q1 (fiscal year 2022, quarter one) earnings are in. As is the trend for Microsoft, it increased revenue by a sizeable percentage (22% year-over-year), coming in with $45.3 billion and beating Wall Street estimates yet another quarter in a row. The company highlighted its earnings as follows:

- Revenue was $45.3 billion and increased 22%

- Operating income was $20.2 billion and increased 27%

- Net income was $20.5 billion GAAP and $17.2 billion non-GAAP, and increased 48% and 24%, respectively

- Diluted earnings per share was $2.71 GAAP and $2.27 non-GAAP, and increased 49% and 25%, respectively

- GAAP results include a $3.3 billion net income tax benefit explained in the Non-GAAP Definition section below

Microsoft Cloud was cited as a major breadwinner this quarter, pulling in $20.7 billion in revenue. That's a 36% year-over-year (YoY) jump.

Cloud, productivity, and computing gains

Productivity and Business Processes revenue was up by 22% YoY thanks to $15 billion in revenue. Below are the key elements that came together to make that number possible:

- Office Commercial products and cloud services revenue increased 18% (up 16% in constant currency) driven by Office 365 Commercial revenue growth of 23% (up 21% in constant currency)

- Office Consumer products and cloud services revenue increased 10% (up 8% in constant currency) and Microsoft 365 Consumer subscribers increased to 54.1 million

- LinkedIn revenue increased 42% (up 39% in constant currency) driven by Marketing Solutions growth of 61% (up 59% in constant currency)

- Dynamics products and cloud services revenue increased 31% (up 29% in constant currency) driven by Dynamics 365 revenue growth of 48% (up 45% in constant currency)

Keep an eye on LinkedIn revenue over the following quarters given the news surrounding the service and how future quarters may be impacted.

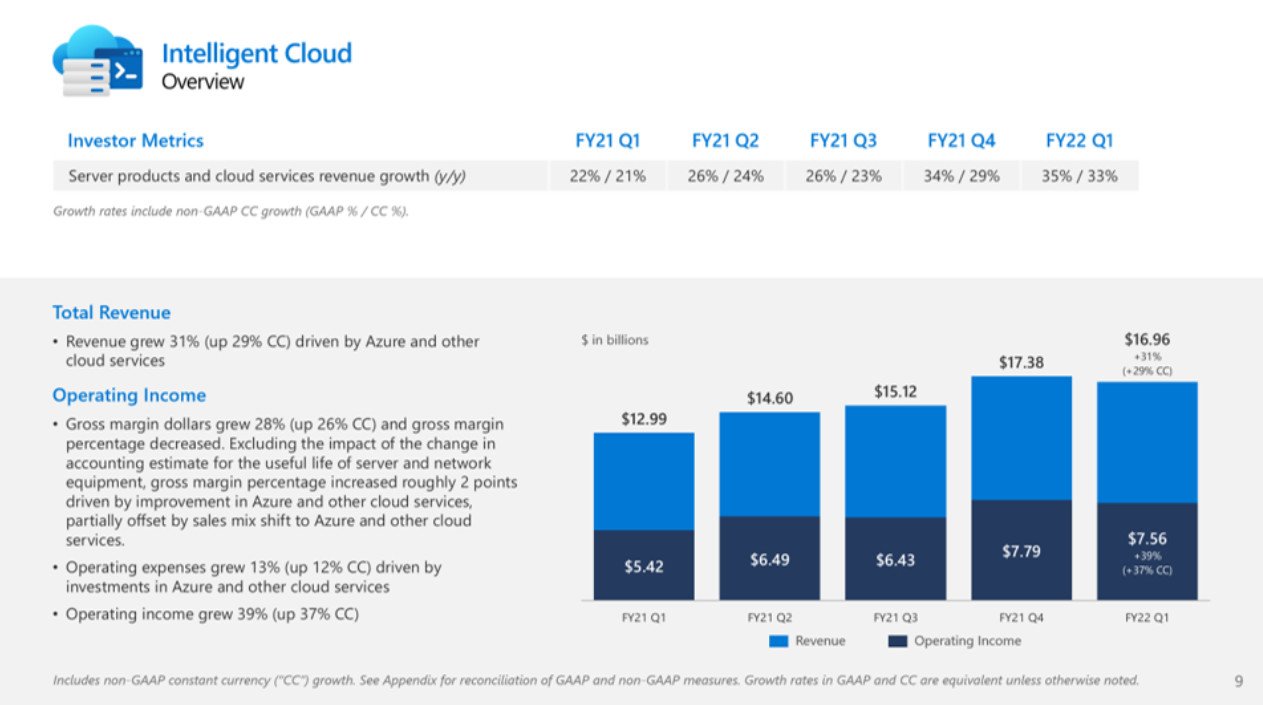

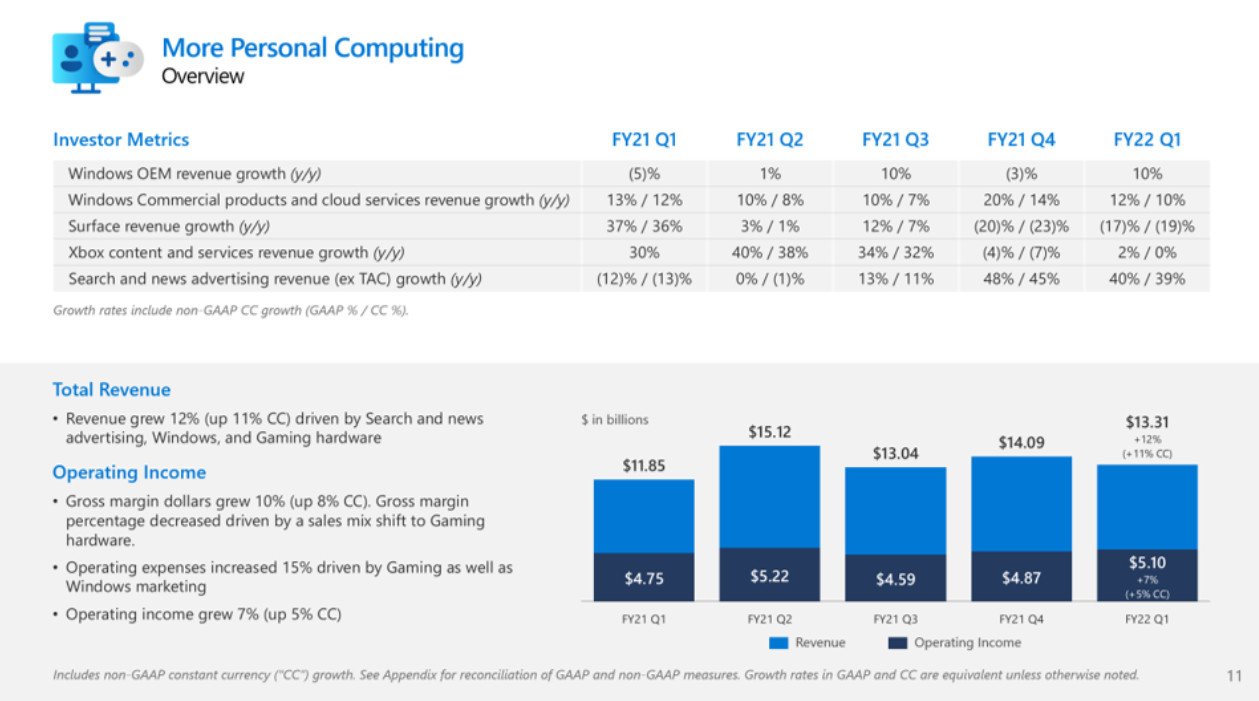

Intelligent Cloud saw a 31% jump with $17 billion in revenue. And More Personal Computing (yes, that's the category name) hit $13.3 billion, which represents a 12% jump year-over-year. News advertising, Windows (once again, bid welcome to Windows 11), and gaming hardware were contributors to the division's success. Here are the highlights from that category:

- Windows OEM revenue increased 10%

- Windows Commercial products and cloud services revenue increased 12% (up 10% in constant currency)

- Xbox content and services revenue increased 2% (relatively unchanged in constant currency)

- Search and news advertising revenue excluding traffic acquisition costs increased 40% (up 39% in constant currency)

- Surface revenue decreased 17% (down 19% in constant currency)

As can be seen via the graphs and images above, as well as the highlight bullets, though Microsoft's cloud business saw gains, other departments didn't have booming revenue growth for the quarter, including the Surface line of products. However, other Microsoft hardware, such as the Xbox Series X and S, saw jumps. Those consoles contributed to Xbox hardware revenue percentage gains of 166% year-over-year. For Xbox content and services, third-party titles didn't hold up as well as usual but were partially balanced out by Xbox Game Pass revenue and first-party title successes.

All the latest news, reviews, and guides for Windows and Xbox diehards.

What's next

As is the standard, every quarter after Microsoft releases its report, it holds an investor call later in the day. You can listen in on the call at 2:30 p.m. PT / 5:30 p.m. ET over at the company's investor portal. You'll want to listen in if you're interested in hearing figures and nuggets of information not quite standard for earnings report coverage but still enlightening about the company's upcoming plans and general trajectory.

Here's a general overview of what Microsoft said during its call:

- Microsoft's Nuance acquisition is expected to close by Q2 or early Q3.

- Another strong quarter is anticipated.

- Quarterly volatility from Azure contracts is expected.

- Capital expenditures will be in line with the last quarter.

- On-premise business will decline as people move to the cloud.

- LinkedIn is expected to grow revenue by somewhere in the mid-30% range.

- Azure will drive the Intelligent Cloud business.

- $16.35-16.75 billion in revenue is anticipated for the More Personal Computing category.

- Surface revenue is expected to decline again by single digits, due to supply chain issues.

- Xbox hardware will also have to wrestle with supply chain issues but is expected to grow by "high single digits."

In other words, nothing radical or vastly different than what we've seen in the trends from the last few quarters.

Robert Carnevale was formerly a News Editor for Windows Central. He's a big fan of Kinect (it lives on in his heart), Sonic the Hedgehog, and the legendary intersection of those two titans, Sonic Free Riders. He is the author of Cold War 2395.