Microsoft Q4 2020 earnings: $38 billion in revenue, beating expectations

Analysts averages pegged Microsoft's expected earnings at around $36.5 billion.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

What you need to know

- Microsoft brought in $38 billion in revenue during Q4 2020.

- That's up 13 percent over the same period last year.

- Microsoft's commercial cloud business surpassed $50 billion in annual revenue for the first time.

Microsoft today reported its earnings results for the fourth quarter of its 2020 fiscal year. In all, Microsoft says it brought in $38 billion in revenue, which is up 13 percent over the same period last year. That beat analyst expectations, which averaged around $36.5 billion going into today's results.

The surge comes as companies continue to deal with the impacts of the COVID-19 pandemic. With more people working from home, Microsoft saw demand for its cloud segments increase. "In the Productivity and Business Processes and Intelligent Cloud segments, cloud usage and demand increased as customers continued to work and learn from home," the company said in its earnings release.

However, Microsoft took hits in its licensing and LinkedIn businesses. "Transactional license purchasing continued to slow, particularly in small and medium businesses, and LinkedIn was negatively impacted by the weak job market and reductions in advertising spend," Microsoft said.

Here are some of the highlights from this quarter:

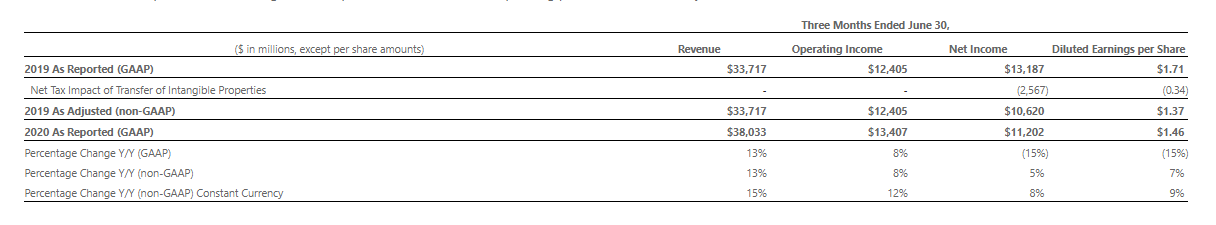

- Revenue was $38.0 billion and increased 13%

- Operating income was $13.4 billion and increased 8%

- Net income was $11.2 billion and decreased 15% GAAP (up 5% non-GAAP)

- Diluted earnings per share was $1.46 and decreased 15% GAAP (up 7% non-GAAP)

In Microsoft's "More Personal Computing" segment, which encompasses Windows, Surface, and Xbox, it saw solid growth as demand increased from people looking to work, play, and learn from home. Of note is that Xbox content and services revenue jumped 65 percent, while Surface revenue increased 28 percent. Windows OEM and Windows commercial products and services revenues were also up by 7 percent and 9 percent, respectively.

Search advertising revenue saw a decrease of 18 percent year-over-year. In total, More Personal Computing brought in $12.9 billion in revenue, a 14 percent increase.

For the "Productivity and Business Processes" segment, revenue was up six percent to $11.8 billion. This was driven by an increase in Office cloud services on the commercial and consumer sides of five percent and six percent, respectively. LinkedIn saw a revenue increase of 10 percent, while Dynamics products and cloud services grew 13 percent.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Finally, the "Intelligent Cloud" segment jumped 17 percent to $13.4 billion in revenue. Server products and cloud services saw an increase of 19 percent, while enterprise services revenue remained "relatively unchanged."

For the full 2020 fiscal year, Microsoft reports a total of 143 billion in revenue, which is an increase of 14 percent of its 2019 fiscal year. Operating income increased 23 percent to $53 billion, while net income grew 13 percent to $44.3 billion.

Microsoft will hold a webcast at 5:30 pm ET / 2:30 pm PT to go over the numbers and its guidance for next quarter. You can listen in at Microsoft's investor relations site.

Dan Thorp-Lancaster is the former Editor-in-Chief of Windows Central. He began working with Windows Central, Android Central, and iMore as a news writer in 2014 and is obsessed with tech of all sorts. You can follow Dan on Twitter @DthorpL and Instagram @heyitsdtl.