Is Xbox Game Pass in trouble?

Xbox Game Pass is under scrutiny, owing to Microsoft's comments to the UK regulatory CMA group.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

Xbox Game Pass is under the spotlight, and it's not necessarily positive.

Recently, Microsoft began its correspondence with the UK regulatory body, known as the CMA. The CMA issued a set of concerns in response to Microsoft's acquisition of Activision, much of which revolves around how it could impact Sony PlayStation's market leadership position. Regardless, that's not exactly what we're here to discuss today.

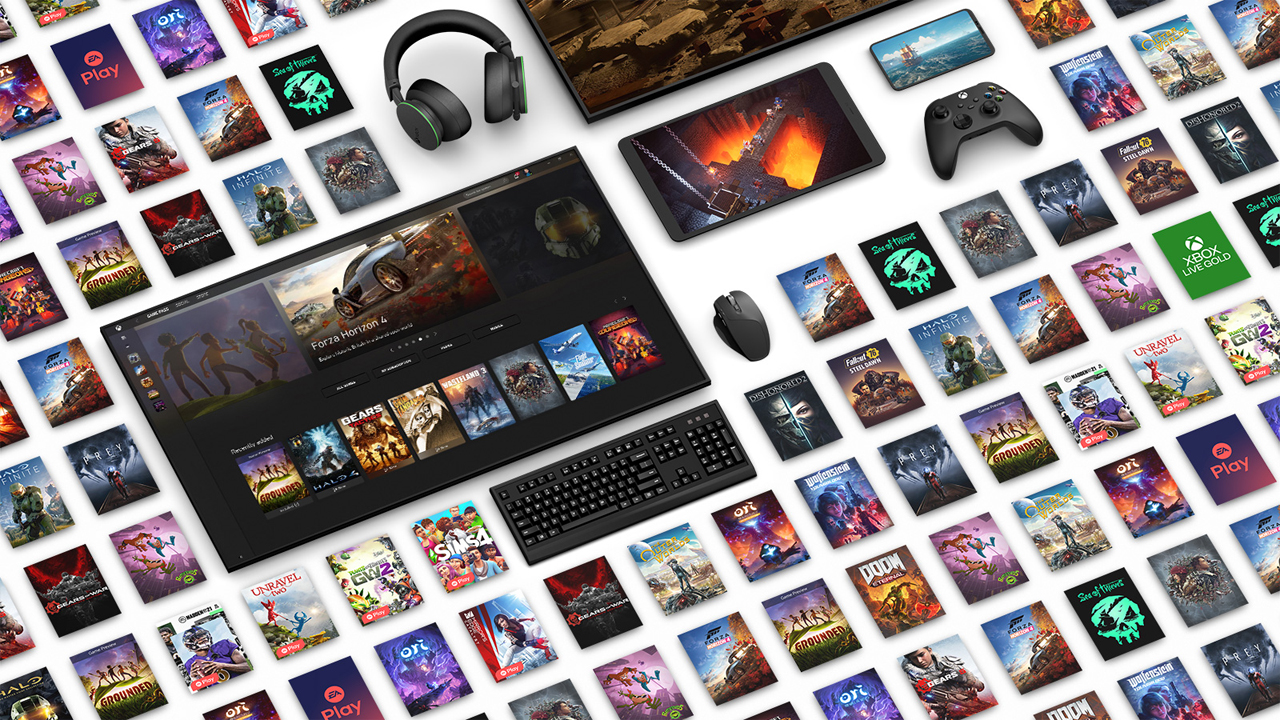

Today, we're looking into Microsoft's comments to the CMA in response to that examination, namely Xbox Game Pass, the model which serves as the vehicle for its cloud gaming aspirations. On a monthly subscription, Microsoft offers hundreds of third-party games in the service. However, contention revolves around the fact it includes all of its exclusives, many of the best Xbox games, as day-one entries. This means that users can skip paying $70 for a full-price title and get it for essentially $10, for a month's worth of access.

For years, people have wondered if the service is too good to be true and if Microsoft is simply burning cash. Microsoft has claimed that Xbox Game Pass is viable publicly, going as far as to tie exec bonuses to the growth of the service. However, Microsoft's recent comments to the CMA seem to run counter to some of its previous claims about how Xbox Game Pass impacts game sales, leading to a flurry of headlines across the core games media.

Let's examine exactly what is being claimed here, and what it could mean for Xbox Game Pass' future, and by extension, Xbox itself.

Xbox Game Pass: The Claims

The flurry of scrutiny was triggered by Microsoft's own comments in the discussion with the CMA, over Microsoft's acquisition of Activision-Blizzard. Therein, Microsoft admitted that Xbox Game Pass hurts full game sales, which seems to run counter to Microsoft Gaming CEO Phil Spencer's comments that Xbox Game Pass boosts retail sales. At least, that's what the headlines suggest, but when you dig a little deeper, there was a pretty notable caveat.

GameIndustry.biz refers to this comment Spencer made in 2018 with regard to sales being boosted by Xbox Game Pass: "When you put a game like Forza Horizon 4 on Game Pass, you instantly have more players of the game, which is actually leading to more sales of the game." I think it's pretty notable here that Spencer said "like Forza Horizon 4," which is, of course, is the nuanced aspect of the discussion that has escaped some of the discussion.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Indeed, from conversations I've had with Microsoft, it seems to be multiplayer games and co-op-oriented games that see a boost from Xbox Game Pass inclusion, rather than your typical single-player title. That being said, the recently released Xbox title HiFi Rush is wholly single-player, and despite day one inclusion in Xbox Game Pass, it managed to garner an impressive position on the Steam charts during launch.

So what did Microsoft say to the CMA?

To the CMA, Microsoft admitted that Xbox Game Pass leads to a "redacted" decline in retail sales of games, without adding specifics.

"Microsoft also submitted that its internal analysis shows a [redacted]% decline in base game sales twelve months following their addition on Game Pass."

"Microsoft internal documents recognize that adding titles to Game Pass would lead to cannibalization of B2P sales," it continues, with B2P referring to "buy to play" games, i.e. retail, as opposed to F2P "free to play" games.

The debate here revolves around the CMA wanting to protect Sony's market leadership position, which the CMA fears could be harmed by Call of Duty's inclusion in Xbox Game Pass. The worry being that Call of Duty may sell less at retail on PlayStation if it can be acquired for less via Xbox Game Pass, as opposed to whether or not Xbox Game Pass is a viable business model at the outset.

In a statement to Eurogamer, Microsoft skirted around the subject, declining to acknowledge or deny its claims to the UK regulatory body.

"Xbox Game Pass offers gamers and game creators more choice and opportunity in how they discover, experience, and deliver games. For gamers, that means providing another option for them to discover games and play with friends at a great value. For developers, that means creating another option for how they monetize their games."

"We're focused on helping game creators of all sizes maximize the total financial value they receive through Game Pass. Each game is unique, so we work closely with creators to build a custom program to reflect what they need, ensure they are compensated financially for their participation in the service, and allow room for creativity and innovation. As a result, the number of developers interested in working with Game Pass continues to grow."

Xbox Game Pass: Does the business work?

We're reading the tea leaves a bit here, since Microsoft doesn't really give us a granular overview of how Xbox Game Pass is doing. The implication that Xbox Game Pass reduces the lucrative B2P segment over time seems to contribute to this idea that it is unsustainable since common sense suggests big AAA games depend on big AAA sales to be viable. It's a little different if you're an ecosystem owner, though, as we'll get into shortly.

When assessing viability, we need to look at a few verticals here. Microsoft doesn't share Xbox Game Pass subscriber numbers, however, outside of a few major milestones. The last official figure we received from the firm puts Xbox Game Pass at 25 million subscribers. Rumors suggest this is behind Microsoft's projections, although Microsoft asserts that their projections are intentionally aggressive. Axios reported that Xbox Game Pass was targeting a 78% growth rate in 2022, but only achieved 28%.

Regardless, growing Xbox Game Pass ultimately doesn't matter if it isn't profitable — Microsoft is a business at the end of the day. At events, speaking candidly, Xbox sources have asserted to me that Xbox Game Pass is profitable, without offering details on how that is measured. Clearly, Microsoft is enthusiastic about the service, essentially tying the entire Xbox brand up to it. The Xbox dashboard itself is effectively just a big splash screen for Xbox Game Pass these days, for better or worse. I feel like if the service was a dire mistake, it would have already seen a quiet and gradual reduction in visibility by now.

There are some other real world examples we can point to when exploring Xbox Game Pass' viability as a business entity.

Netflix is the obvious comparison to speak of here. Netflix is a huge success story, with over 32 billion dollars in revenue and billions in net profits. It's superficially a similar business to Xbox Game Pass, offering TV shows and movies for a relatively low monthly fee. Netflix' explosion onto the scene really changed the way many of us consume media, and could be referred to as a vision for where Xbox Game Pass could go in the future.

Spotify and its music subscription service is arguably the opposite end of the comparison league, given that it has never really turned in any form of consistent operating profits. Spotify by and large is funded by ads on its free tier and subscriptions on its paid tier, and looking at the firm's earning reports, it certainly seems as though the business doesn't work. Spotify is losing hundreds of millions of dollars every year, and announced a round of layoffs to try and reduce costs a few weeks back. Spotify has a library of millions of songs and podcasts with little curation, and has struggled to figure out how to monetize its userbase despite its ad offerings.

Still, Spotify has almost 12 billion dollars in revenue, and could very easily flip into serious profitability at some point if it can figure out its monetization strategy. It could also very much not flip into profitability. Spotify suffered similar share price retreats that other big tech firms endured over the past year, although it has started to rally recently.

Investors stick with Spotify on the basis of faith in the future of its business model. One case study from Moiglobal investors back in 2020 suggested that the music streaming market is still in an "early innings" adoption phase, which is mind-blowing if you consider the fact Spotify launched back in 2011 in the United States. Spotify is already the biggest music service on the market by a sizeable amount, and it's difficult to imagine how it could possibly grow further from this point. Are there really people out there that still don't know Spotify exists? I'm sure investors know better than me, although I'd be curious what their thoughts are on the current state of Spotify, given that it has posted only net losses since 2020.

In any case, it's still a clunky comparison to make with regard to Xbox Game Pass. Xbox Game Pass isn't all about the subscription, despite what you might assume. Xbox Game Pass is a supplementary aspect of an entire ecosystem of products, and I think that's how Microsoft views it internally when it talks about profitability.

Even if we assume Xbox Game Pass itself is not profitable by itself, as part of Xbox, it doesn't exist in a vacuum. It's essentially Xbox's best "exclusive" feature right now, bringing users into the wider spending ecosystem.

Microsoft doesn't talk about it publicly so much, but one of the metrics Microsoft uses internally to describe Xbox's performance is "NTX" stats, i.e. users that are "new to Xbox." Many of those users come in as a result of seeking the value Xbox Game Pass offers. They will go on to buy hardware, and microtransactions in Call of Duty and Overwatch, they will buy accessories, and, of course, they will subscribe to Xbox Game Pass. To that end, even if we assume Xbox Game Pass itself is not profitable by itself, as part of Xbox, it doesn't exist in a vacuum. It's essentially Xbox's best "exclusive" feature right now, bringing users into the wider spending ecosystem. If a "new to Xbox" user joined the ecosystem because of Xbox Game Pass, how does that count towards cannibalization? There's been indication to me that a user saving money on Xbox Game Pass will continue to spend on other aspects of their Xbox experience, too, which again, sort of contradicts the cannibalization argument.

Even still, if some investors were considering Spotify to be "early" back in 2020, surely Xbox Game Pass is very aggressively still "early." The landscape it operates in could look very different in a few years.

Xbox Game Pass: The future

25 million users is tiny, ultimately. The market of gamers exists in the billions, and Microsoft's goal is to wield Xbox Game Pass as a carrot to get users to bite into the Xbox stick. Sheer value alone isn't enough, though, as Spotify is likely discovering, and Netflix has very firmly discovered previously. What matters is exclusive, culturally-significant content, and that is an area Xbox Game Pass is arguably very much lacking in right now.

Microsoft's admission that Xbox Game Pass cannibalizes retail sales is exactly the reason why you haven't seen Activision offer an "Activision Game Pass" service of its own, and why you've only seen EA and PlayStation offer content after long periods at retail. I would argue that we haven't really seen how Xbox Game Pass can truly perform if it ever was to get a mega-hit, like an Elder Scrolls VI, or a Fallout 5, or, you know, a Starfield, which is tentatively slated for launch before the summer this year. Microsoft's first-party hasn't been able to produce the kind of culturally-relevant mega hits on the same scale as a Squid Game for Netflix, or a Last of Us for PlayStation, and that is undoubtedly a barrier to the service's growth, and by extension, viability as a business.

There are other significant barriers, too. Chiefly among these is the anti-competitive policies of the Google Play and iOS app stores, which prevent Microsoft and its publishing partners from offering in-game purchases via Xbox Game Pass' cloud platform.

In the case of iOS, Apple simply outright blocks Xbox Game Pass in its entirety. In essence, Apple reduces competition and potential value for consumers, while it continues to promote shallow free-to-play experiences that skew more towards gambling than gaming.

Apple and Google are the biggest players in gaming that don't actually make games, and the fact that these companies dictate the direction of gaming on mobile platforms represents an existential threat to companies building deeper experiences across PC, PlayStation, Nintendo, and Xbox. Xbox lead Phil Spencer himself said Xbox would become "untenable" without a mobile presence, and Apple and Google make it as hard as humanly possible for platforms to remain profitable in that space.

The good news is that both of these barriers aren't unbreakable. Microsoft's acquisition of ZeniMax is likely to bear its first real fruit this year in the form of Starfield, which you can bet will be heavily marketed alongside Xbox Game Pass. If Microsoft does manage to land Activision-Blizzard, it will have games like Call of Duty and Diablo IV to place into Xbox Game Pass, boosting its "culturally relevant" credentials in the process. It's these "big" Xbox Game Pass moments that seem to lead to the kind of virality that boost sales of games even at retail, and even on other competing platforms. I suspect we'll have some hard data on what that might look like when Starfield launches later this year.

And with regard to in-game purchases and DLC on Xbox Game Pass, Apple and Google are already under heavy scrutiny from regulators in the European Union about their store practices. There are some hints that the EU could be preparing legislation to break their preventative practices on competing app stores. Were iOS and Android to become more open like Windows PC in that regard, it would undoubtedly increase the viability of services like Spotify, Netflix, Xbox Game Pass, and Nvidia GeForce Now, and even lower the barrier to entry to further competitors who can't find profitability in a world where Apple and Google arbitrarily take 30%.

There's a lot of negativity out there about the Xbox Game Pass business model, and whether or not it makes sense as a business venture for Microsoft or even partner studios. The reality is that it's still very early days. We've not seen Xbox Game Pass acquire its "killer app" yet, nor have we seen Xbox cloud gaming really hit critical mass. There may be a future where the day-one Xbox Game Pass inclusion of major games and the subsequent "cannibalizing" B2P channels becomes prohibitive for Xbox, but given the wide variety of alternative revenue streams Xbox has an ecosystem, it's hard to envision such a scenario at this point.

Given the volume of factors that have yet to come into play, it would be short-sighted — and dare I say — a little silly, to rule out Microsoft's Xbox Game Pass strategy at present.

Jez Corden is the Executive Editor at Windows Central, focusing primarily on all things Xbox and gaming. Jez is known for breaking exclusive news and analysis as relates to the Microsoft ecosystem — while being powered by tea. Follow on X.com/JezCorden and tune in to the XB2 Podcast, all about, you guessed it, Xbox!