Surface drove positive revenue for Microsoft's More Personal Computing division for Q3 2016

Microsoft is reporting their Q3 2016 financial results today and the consumer division under the rubric of More Personal Computing. This category includes Surface, Phone, and Xbox Live membership along with the all important Windows OEM revenue.

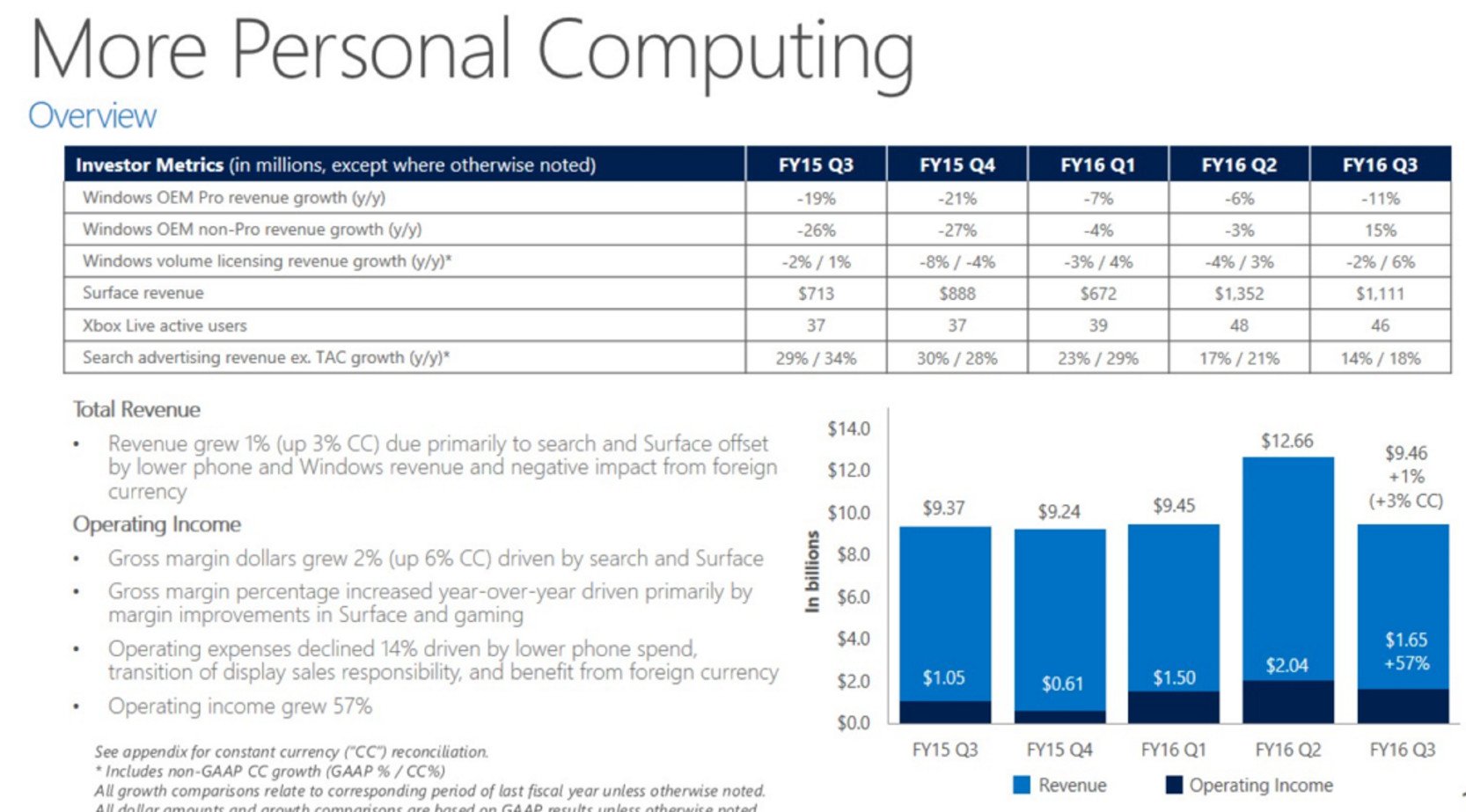

The good news is overall the More Personal Computing division had $9.5 billion in revenue, which is up 1% (up 3% in constant currency). High growth was seen with sales of the Surface line and increased Xbox Live adoption up 26% year-over-year to 46 million users.

Surface revenue was at $1.1 billion for Q3 2016, which is up from $713 million year-over-year and slightly down from the peak holiday season at $1.3 billion.

- Windows OEM revenue declined 2% in constant currency, outperforming the PC market, driven by higher consumer premium device mix

- Surface revenue increased 61% in constant currency driven by Surface Pro 4 and Surface Book

- Phone revenue declined 46% in constant currency

- Xbox Live monthly active users grew 26% year-over-year to 46 million

- Search advertising revenue excluding traffic acquisition costs grew 18% in constant currency with continued benefit from Windows 10 usage

Windows OEM revenue declined by 2%, which is never a good thing. However, it did outperform the general PC market overall. Microsoft attributes that discrepancy to "higher consumer premium device mix", which is a significant shift as the low-end market rarely yields significant revenue due to low margins. Success in the high-end market is key for Microsoft as they continue a premium experience and hardware through their Surface line.

The Phone segment continued to decline by 46%. That drop follows a 49% percent drop by in Q2. Middling sales and lack of a market push for the Lumia 650, Lumia 950, and Lumia 950 XL are not suprpringly resulting in a lower market share for Windows Phone.

Finally, Search advertising revenue grew 18% driven by Windows 10 usage and is another positive sign.

Overall, Microsoft's More Personal Computing segment appears to be stabilizing and performing well with positive growth in nearly all areas except phone, which is not at all surprising due to their retrenchment policy through 2016. Wall Street will likely be happy with the Windows OEM revenue performance, increased Surface adoption and evident success in the premium segment of the computer market.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Daniel Rubino is the Editor-in-Chief of Windows Central. He is also the head reviewer, podcast co-host, and lead analyst. He has been covering Microsoft since 2007, when this site was called WMExperts (and later Windows Phone Central). His interests include Windows, laptops, next-gen computing, and wearable tech. He has reviewed laptops for over 10 years and is particularly fond of Qualcomm processors, new form factors, and thin-and-light PCs. Before all this tech stuff, he worked on a Ph.D. in linguistics studying brain and syntax, performed polysomnographs in NYC, and was a motion-picture operator for 17 years.