Xbox revenue up 6% as Xbox hardware tops U.S. sales charts

Xbox holds the momentum with Microsoft's latest Q3 earnings.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

What you need to know

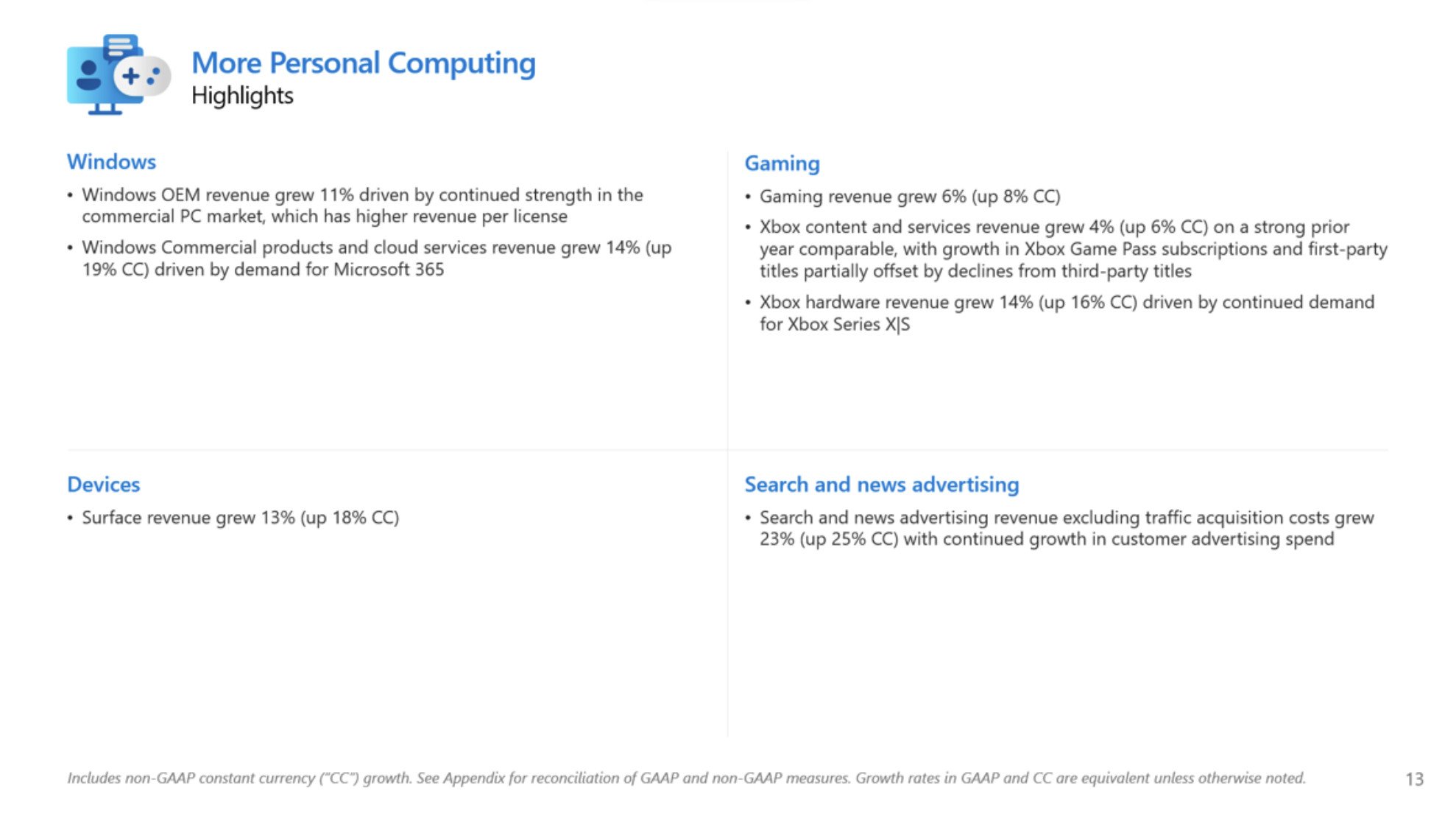

- Microsoft announced its FY22 Q3 earnings on Wednesday, with gaming revenue up 6% year-over-year according to the Xbox platform owner.

- The company attributed the growth to a 14% increase in hardware sales attributed to Xbox Series X and Xbox Series S, while content and services also increased by 4%.

Microsoft has announced its third-quarter earnings for its 2022 fiscal year, coupled with the latest update on its gaming efforts. Year-over-year revenue was up 20% company-wide over the period, totaling $51.7 billion. Xbox revenue also climbed 6% this quarter, attributed to growth in Xbox console sales, Xbox Game Pass, and other gaming services.

The latest Q3 figures reflect Microsoft's ongoing efforts to deliver its newest Xbox Series X and Xbox Series S consoles to consumers, with high demand and supply constraints still prevalent over one-year post-release. With availability steadily improving, notably for its more affordable Xbox Series S, hardware revenue grew 14% this quarter. It shows the consoles maintaining momentum following a 232% surge in hardware revenue this time last year, after topping the U.S. in dollar sales for March 2022 according to NPD.

Xbox content and services also increased 4%, with Microsoft outlining its Xbox Game Pass service and in-house first-party titles among successes. It follows the launch of Xbox Game Studios-published titles like Halo Infinite and Forza Horizon 5 last holiday, helping drive its subscriptions on consoles and PCs. Revenue was reportedly offset by several unnamed third-party titles from the previous fiscal year.

The news comes as Microsoft continues to invest in growing its Xbox content and services, including Xbox Game Pass, with sights set on new platforms. The service now touches consoles, PC, and mobile devices via cloud streaming, with support for more platforms also in the works. The industry-shaking planned acquisition of Activision Blizzard for $68.7 billion also remains underway, showcasing its commitment to supporting its gaming platform and services.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Matt Brown was formerly a Windows Central's Senior Editor, Xbox & PC, at Future. Following over seven years of professional consumer technology and gaming coverage, he’s focused on the world of Microsoft's gaming efforts. You can follow him on Twitter @mattjbrown.