Nokia sale to Microsoft expected to close on April 25

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

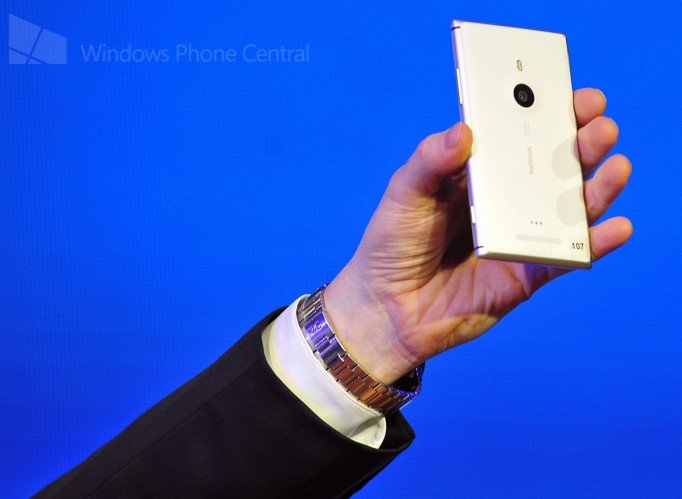

Nokia sale to Microsoft expected to close on April 25

It was nearly eight months ago that Microsoft and Nokia announced a deal to sell Nokia's Devices and Services unit to Microsoft for €5.44 billion (US$7.3 billion), and this week that deal is finally going to close. Friday, April 25th, will see Nokia Devices and Services transferred to Microsoft and renamed as Microsoft Mobile Oy.

The process was expect to take a several months, and unsurprisingly so large of an acquisition of so iconic a company as Nokia ran into some hurdles. But it wasn't the US Department of Justice, the European Commission, or even Nokia shareholders that caused issues — it was a massive tax bill the Indian government claimed Nokia owed that ended with more than half a billion dollars put into an escrow account, as well as concerns raised by Korean manufacturers to the Fair Trade Commission

With all of that out of the way, Nokia anticipates that only "certain customary closing conditions" remain between now and Friday's closing.

Brad Smith, Microsoft General Counsel and EVP Legal & Corporate Affairs, chimed in on the Official Microsoft Blog:

"The completion of this acquisition follows several months of planning and will mark a key step on the journey towards integration. This acquisition will help Microsoft accelerate innovation and market adoption for Windows Phones. In addition, we look forward to introducing the next billion customers to Microsoft services via Nokia mobile phones."

He noted that adjustments have been made since the announcement of the deal. Microsoft will now be taking over management of Nokia.com and Nokia's social media accounts, Nokia's Chief Technology Office and its 21 employees in China will be joining Microsoft, and Nokia's Korean manufacturing facility with stay with the remnants of Nokia and not become property of Microsoft.

Goodbye, Nokia. Hello, Microsoft Mobile.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Press release:

Nokia expects the sale of substantially all of its Devices & Services business to Microsoft to close on April 25, 2014

Espoo, Finland - Nokia today announced that it expects the transaction whereby the company will sell substantially all of its Devices & Services business to Microsoft to close on April 25, 2014. The transaction is now subject only to certain customary closing conditions.

The transaction was originally announced on September 3, 2013.

FORWARD-LOOKING STATEMENTS

It should be noted that Nokia and its business are exposed to various risks and uncertainties and certain statements herein that are not historical facts are forward-looking statements, including, without limitation, those regarding: A) the planned sale by Nokia of substantially all of Nokia's Devices & Services business, including Smart Devices and Mobile Phones (referred to below as "Sale of the D&S Business") pursuant to the Stock and Asset Purchase Agreement, dated as of September 2, 2013, between Nokia and Microsoft International Holdings B.V.(referred to below as the "Agreement"); B) the closing of the Sale of the D&S Business; C) expectations, plans or benefits related to or caused by the Sale of the D&S Business; D) expectations, plans or benefits related to Nokia's strategies, including plans for Nokia with respect to its continuing businesses that will not be divested in connection with the Sale of the D&S Business; E) expectations, plans or benefits related to changes in leadership and operational structure; F) expectations and targets regarding our operational priorities, financial performance or position, results of operations and use of proceeds from the Sale of the D&S Business; and G) statements preceded by "believe," "expect," "anticipate," "foresee," "sees," "target," "estimate," "designed," "aim", "plans," "intends," "focus," "will" or similar expressions. These statements are based on management's best assumptions and beliefs in light of the information currently available to it. Because they involve risks and uncertainties, actual results may differ materially from the results that we currently expect. Factors, including risks and uncertainties that could cause these differences include, but are not limited to: 1) the inability to close the Sale of the D&S Business in a timely manner, or at all, for instance due to the inability or delays in satisfying closing conditions, or the occurrence of any event, change or other circumstance that could give rise to the termination of the Agreement; 2) the potential adverse effect on the sales of our mobile devices, business relationships, operating results and business generally resulting from the announcement of the Sale of the D&S Business or from the terms that we have agreed for the Sale of the D&S Business; 3) any negative effect from the implementation of the Sale of the D&S Business, as we may forego other competitive alternatives for strategies or partnerships that would benefit our Devices & Services business and if the Sale of the D&S Business is not closed, we may have limited options to continue the Devices & Services business or enter into another transaction on terms favorable to us, or at all; 4) our ability to effectively and smoothly implement planned changes to our leadership and operational structure or maintain an efficient interim governance structure and preserve or hire key personnel; 5) any negative effect from the implementation of the Sale of the D&S Business, including our internal reorganization in connection therewith, which will require significant time, attention and resources of our senior management and others within the company potentially diverting their attention from other aspects of our business; 6) disruption and dissatisfaction among employees caused by the plans and implementation of the Sale of the D&S Business reducing focus and productivity in areas of our business; 7) the amount of the costs, fees, expenses and charges related to or triggered by the Sale of the D&S Business; 8) any impairments or charges to carrying values of assets or liabilities related to or triggered by the Sale of the D&S Business; 9) potential adverse effects on our business, properties or operations caused by us implementing the Sale of the D&S Business; 10) the initiation or outcome of any legal proceedings, regulatory proceedings or enforcement matters that may be instituted against us relating to the Sale of the D&S Business, as well as the risk factors specified on pages 12-47 of Nokia's annual report on Form 20-F for the year ended December 31, 2012 under Item 3D. "Risk Factors." and risks outlined in our fourth quarter and full year 2013 results report available for instance at www.nokia.com/financials. Other unknown or unpredictable factors or underlying assumptions subsequently proving to be incorrect could cause actual results to differ materially from those in the forward-looking statements. Nokia does not undertake any obligation to publicly update or revise forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent legally required.

Source: Nokia, Microsoft

Derek Kessler is a Former Special Projects Manager for Mobile Nations. He's been writing about tech since 2009, has far more phones than is considered humane, still carries a torch for Palm, and got a Tesla because it was the biggest gadget he could find. You can follow him on Twitter at @derekakessler.