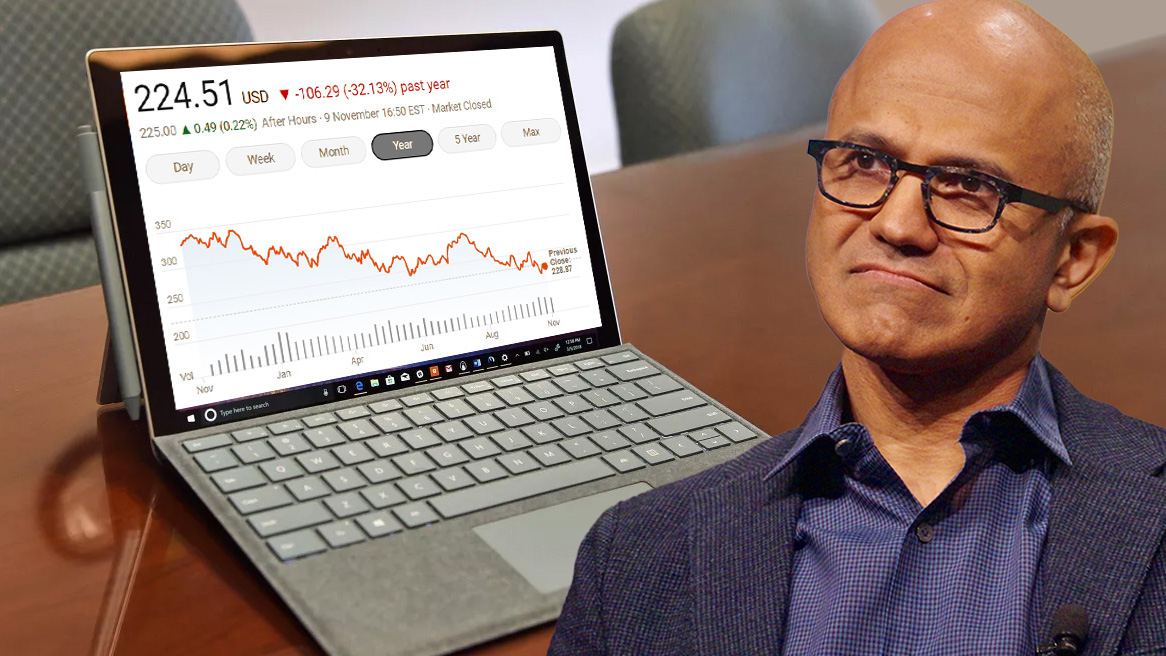

Microsoft is on track to join the $1 trillion lost market value club, but why?

Microsoft may be next in line to join Amazon in this grim economic milestone.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

One phrase I've been hearing more and more of in recent times is "macroeconomic headwinds," and I suspect we'll be hearing more of it in the coming months ahead during Microsoft's financials.

We are moving into tough times for the global economy. After years upon years of Microsoft stock growth, we're finally seeing a long-expected course correction, with various companies enduring a fairly staggering route. It's not millions of dollars we're talking about or even billions, but trillions — and some of the world's biggest tech firms are getting bitten like never before.

Amazon is in fact the first company in the history of the world to lose $1 trillion dollars in value, only a few years after various tech megacorps like Google, Apple, and Microsoft broke into the prestigious $1 trillion dollar market cap club. And it seems Microsoft may be on course to join them.

As of writing, Microsoft is down $900 billion dollars for the year, joining other tech companies like Tencent, Meta (Facebook), and Google who have seen trillions of dollars in market capitalization evaporate over the past year. The amounts are truly unimaginable, outstripping entire countries' worth of GDP.

Although US inflation did unexpectedly fall in recent estimates, a variety of other economic instabilities may contribute to further downturn over the next year. Microsoft is well-placed to weather the storm, though.

Why are tech stocks down?

There are multiple factors behind why tech stocks are underperforming lately. If you listen to Microsoft's financial reports, it seems like a head-scratcher at first glance. Microsoft is consistently beating expectations in some areas while posting solid profits and revenues. The tech stock market correction generally reflects future outlooks, and those sentiments have recently been on a downward trend.

Things like China's Covid-Zero policy impacting supply chains, Russia's war of aggression in Ukraine impacting energy markets, and an inflation bubble caused by quantitative easing from the pandemic are all factors feeding into this air of pessimism. Central banks worldwide have raised interest rates to combat soaring inflation, and those same interest rates impact tech companies' ability to invest in future platforms, services, and other disruptive technology that we saw rise to prominence in the 2010s.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Crucially as well, Russia's war has seen currency markets fluctuate, with investors fleeing the Euro and British sterling (thanks Liz) in favor of the U.S. dollar. Given that Microsoft does a massive amount of its business (roughly half, in fact) overseas, the cost to their business increases as they move profits from countries like Europe back home. This is why you've also seen companies like Sony raise the price of the PlayStation 5 in Europe, but not America.

The past decade really was relentless with regard to how consumers and businesses interact with technology. Microsoft joined Amazon at the very cutting edge of cloud service provision, as more and more of us opted for permanently connected devices and subscription services via what Microsoft used to call the "Intelligent Edge." Microsoft Office went from a boxed product to a subscription service. Xbox is moving deeper into subscription services with Xbox Game Pass. Microsoft is even gearing up to offer Windows itself as a subscription service, with cloud-based computing for consumers.

However, investing in data centers to power this technology is increasingly challenging for a variety of reasons. Interest rates and currency problems notwithstanding, we've also seen masses of disruption to chip supply chains. Energy markets are putting small and medium-sized companies out of business, or at the very least, reducing their willingness to spend. Consumers are also feeling a contraction in their spending power, which also has a knock-on effect across everything. Fundamentally: expenses are going up, and income is going down.

The flood of new money into the economy during the pandemic coupled with a global upheaval in user habits allowed Microsoft and other cloud-oriented tech corps to find, and then meet new demand. PC and laptop sales soared as everyone took to set up their home offices for remote working. Demand for services like Netflix, Xbox gaming, and Amazon shopping led to hiring sprees to meet demand. Much of this growth was financed via borrowing at those historically-low interest rates — a trend now reversing course as central banks seek to drive down inflation.

During the pandemic, speculation was utterly rife about what the landscape might look like with regard to consumer habits and behaviors. Mark Zuckerberg and Facebook (now Meta) rebranded the entire company around this idea of remote working using VR headsets. This gamble led to Meta hiring literally thousands of engineers to meet Zuckerberg's vision of a connected, always-remote working world. Even Microsoft got on board with Meta's metaverse dreams. Although, the piper now wants his due — Facebook announced yesterday that it plans to lay off over ten thousand of those same engineers it hired to meet this vision of a remote world — a reality which remains wholly virtual at best.

Meta is among the biggest losers in the current tech retreat and is uniquely threatened by hubris over the metaverse, Apple's changing ad tracking rules, and rising competition from sites like TikTok. But what about Microsoft? Analysts seem largely split on whether or not tech stocks will rebound to the bull market of the previous decade.

Where's the bottom?

Microsoft, Apple, Google, and Amazon combined represent a whopping 20% of the entire S&P 500 top companies' total value, so their stocks represent a major health check for the current state of the economy. Meta has quite uniquely shot itself in the foot in recent years, but companies like Microsoft and Apple haven't exactly made any major mistakes on the scale of the metaverse or Google Stadia in recent years.

Fears over the war in Europe, supply chain disruption, and "a return to normal" after the pandemic have all impacted how investors see tech stocks — but interest rates seem to be widely fingered as the main culprit for the decline of tech stocks. As companies like Microsoft et al. grew their staff roster to meet demand in an increasingly cloud-based world, rising interest rates, and the super-heated value of the American dollar compound with those other factors to drive up operating costs. Microsoft and other tech companies have issued guidance to warn about profitability through 2023, which some expect will reflect (or even exceed) the 2008 "Great Recession" for instability and declines.

Microsoft can't control interest rates or global currency markets, but it's well positioned to remain a leader in the tech space. Of course, technology is always on the march. User habits change, and new technological breakthroughs disrupt and create markets. Smartphones changed the entire world, and tech companies that capitalized on the rise of the "pocket computer" saw some of the most impressive growth in economic history. Microsoft has repeatedly shown itself to be a disruptor and innovator, and deeper investment in its gaming section should help it offset loses that are doubtless coming to its Windows PC licensing operation. Gaming is often seen as, at least, recession-resistant, after all.

And of course, nobody can predict the future. But many analysts suspect that what we're seeing this year is only the beginning of what could be a painful period in the tech industry.

Jez Corden is the Executive Editor at Windows Central, focusing primarily on all things Xbox and gaming. Jez is known for breaking exclusive news and analysis as relates to the Microsoft ecosystem — while being powered by tea. Follow on X.com/JezCorden and tune in to the XB2 Podcast, all about, you guessed it, Xbox!