Microsoft Q3 2021 earnings: $41.7 billion in revenue, large growth amidst pandemic

Microsoft managed a 19% increase in revenue in the third quarter of the 2021 fiscal year.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

What you need to know

- Microsoft brought in $41.7 billion in revenue over the last quarter.

- That's a 19% year-over-year increase.

- Commercial cloud revenue was up 33% over last year.

Microsoft reported its fiscal year 2021 Q3 results today, revealing that it's pulled in a hefty $41.7 billion in revenue over the last quarter. Here's a highlight from the Q3 earnings report:

- Revenue was $41.7 billion and increased 19%

- Operating income was $17.0 billion and increased 31%

- Net income was $15.5 billion GAAP and $14.8 billion non-GAAP, and increased 44% and 38%, respectively

- Diluted earnings per share was $2.03 GAAP and $1.95 non-GAAP, and increased 45% and 39%, respectively

"Over a year into the pandemic, digital adoption curves aren't slowing down. They're accelerating, and it's just the beginning," said Microsoft's CEO Satya Nadella in the Q3 press release. "We are building the cloud for the next decade, expanding our addressable market and innovating across every layer of the tech stack to help our customers be resilient and transform."

Cloud and commercial bring in big hauls

Microsoft reported $13.6 billion in revenue in Productivity and Business Processes, an increase of 15%. Office products, LinkedIn revenue, and cloud services all saw big gains. These were the highlights:

- Office Commercial products and cloud services revenue increased 14% (up 10% in constant currency) driven by Office 365 Commercial revenue growth of 22% (up 19% in constant currency)

- Office Consumer products and cloud services revenue increased 5% (up 2% in constant currency) and Microsoft 365 Consumer subscribers increased to 50.2 million

- LinkedIn revenue increased 25% (up 23% in constant currency)

- Dynamics products and cloud services revenue increased 26% (up 22% in constant currency) driven by Dynamics 365 revenue growth of 45% (up 40% in constant currency)

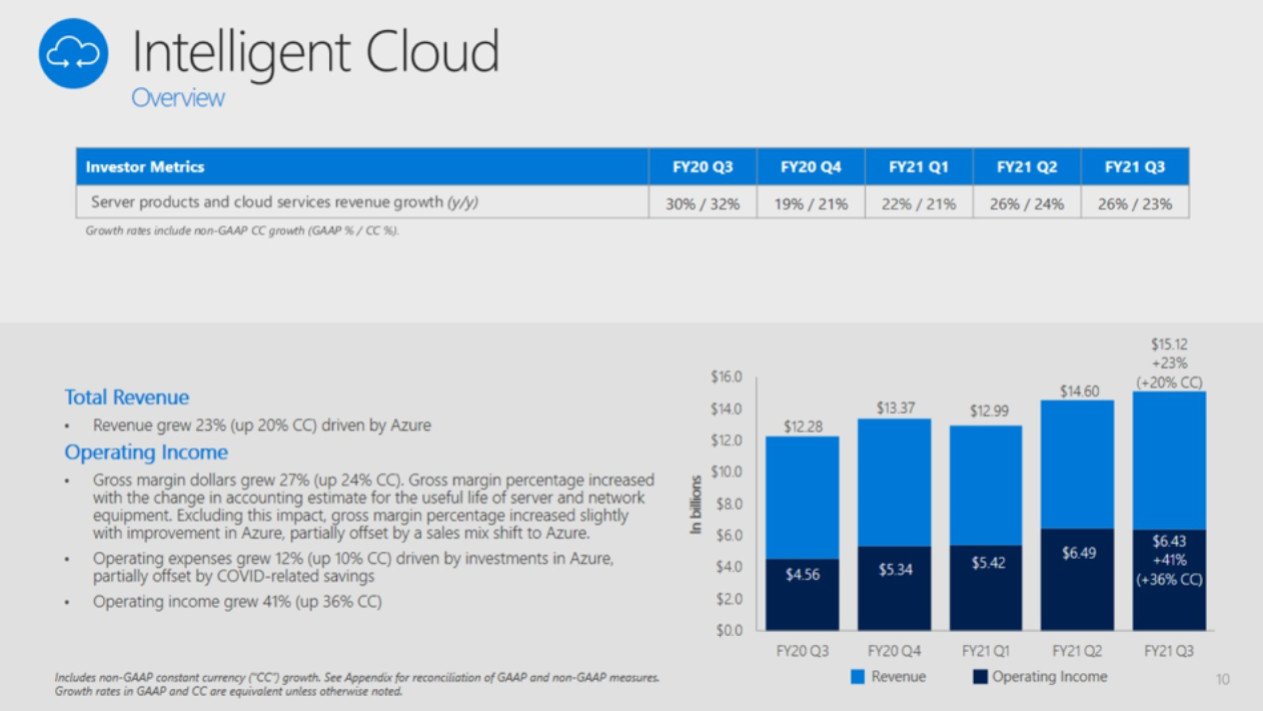

Meanwhile, the Intelligent Cloud space saw $15.1 billion in revenue, marking an increase of 23%. Azure revenue growth was up 50%, enabling a 26% increase in server products and cloud service revenue.

Gaming gains: Xbox, Game Pass, and more raise the bar

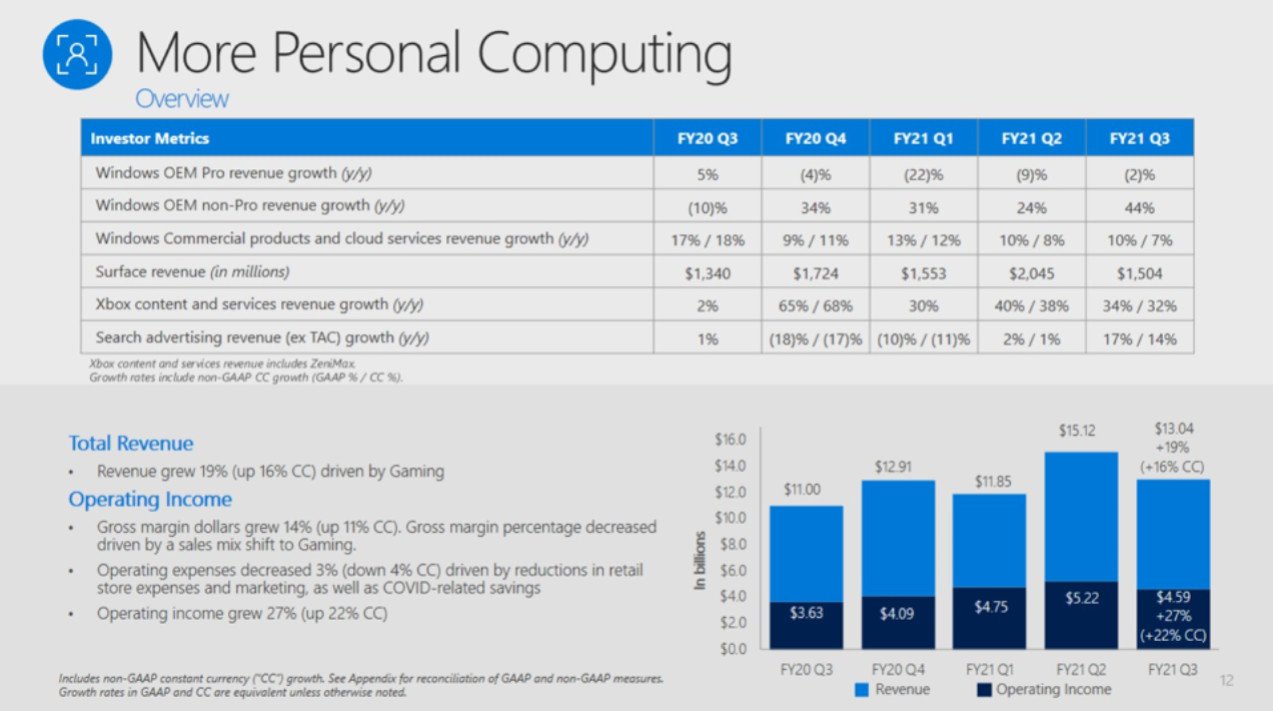

Revenue in More Personal Computing was $13.0 billion, which is a 19% increase. Here are the highlights:

- Windows OEM revenue increased 10%

- Windows Commercial products and cloud services revenue increased 10% (up 7% in constant currency)

- Xbox content and services revenue increased 34% (up 32% in constant currency)

- Search advertising revenue excluding traffic acquisition costs increased 17% (up 14% in constant currency)

- Surface revenue increased 12% (up 7% in constant currency)

Gaming revenue as a whole grew 50%, with part of the 34% growth in Xbox content mentioned above attributed to Game Pass subscriptions and strong games lineups consisting of first and third-party titles.

Surface revenue is up to $1.5 billion or 12% YoY. That number compares favorably to the peak of $2 billion from the last quarter driven by holiday sales. Overall, Surface continues to grow at a steady and modest pace despite chip shortages and increased competition.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Windows 10 OEM revenue is also up 10%, driven by solid consumer PC demand (Pro licenses were down by 2%, but non-Pro revenue is up a staggering 44%). Even Bing search advertising is up 17% YoY with "improved customer advertising spend."

As the reports show, the pandemic has only accelerated growth for Microsoft in a great many areas.

Microsoft will hold its standard quarterly earnings call at 5:30 p.m. ET to provide more insights on its quarter three results, which can be listened to via Microsoft's site.

Robert Carnevale was formerly a News Editor for Windows Central. He's a big fan of Kinect (it lives on in his heart), Sonic the Hedgehog, and the legendary intersection of those two titans, Sonic Free Riders. He is the author of Cold War 2395.