Microsoft Surface FY21 Q2 revenue hits over $2 billion for the first time

Surface had another outstanding quarter with a slight uptick in sales year over year.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

What you need to know

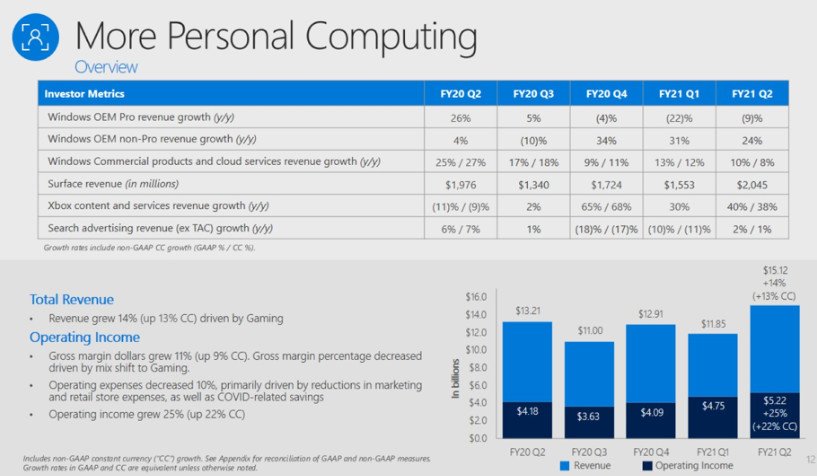

- Surface FY21 Q2 earnings surpassed two billion dollars for the first time.

- Windows OEM license growth was also up by one percent.

- Microsoft's total revenue last quarter was a massive $43.1 billion.

Microsoft reported its FY21 Q2 earnings today, bringing in a massive $43.1 billion up 17 percent year over year from $36.9 billion.

Falling under More Personal Computing is Microsoft's Surface devices, which for the first time broke $2 billion, a modest increase year over year of three percent.

The results are boosted by holiday sales, where Microsoft has become a bit more aggressive in pricing, often offering discounts on its increasingly extensive Surface offerings.

Microsoft does not break out the Surface numbers individually, so it is unclear which device is selling the best. Microsoft launched Surface Pro X (SQ2) and Surface Duo this year along with its existing lineups of Surface Laptop Go, Surface Pro 7, Surface Book 3, Surface Go 2, and Surface Laptop 3.

Windows OEM growth was also up slightly by 1 percent, a mix of declining OEM Pro revenue (down 9 percent) and a significant uptick in OEM non-Pro licenses (up 24 percent).

Microsoft CEO Satya Nadella commented on today's earnings:

What we have witnessed over the past year is the dawn of a second wave of digital transformation sweeping every company and every industry," said Satya Nadella, chief executive officer of Microsoft. "Building their own digital capability is the new currency driving every organization's resilience and growth. Microsoft is powering this shift with the world's largest and most comprehensive cloud platform.

Xbox also did exceptionally well with a massive 51 percent jump in revenue due to high demand for Xbox Series X and Series S.

All the latest news, reviews, and guides for Windows and Xbox diehards.

More details about Microsoft's quarterly performance are due later this afternoon during the earnings call.

Daniel Rubino is the Editor-in-Chief of Windows Central. He is also the head reviewer, podcast co-host, and lead analyst. He has been covering Microsoft since 2007, when this site was called WMExperts (and later Windows Phone Central). His interests include Windows, laptops, next-gen computing, and wearable tech. He has reviewed laptops for over 10 years and is particularly fond of Qualcomm processors, new form factors, and thin-and-light PCs. Before all this tech stuff, he worked on a Ph.D. in linguistics studying brain and syntax, performed polysomnographs in NYC, and was a motion-picture operator for 17 years.