Microsoft Surface and Windows FY21 Q4 revenue see declines due to ongoing 'supply chain constraints'

The chip shortage is having a significant impact on Microsoft's More Personal Computing revenue – while demand is high, supply is low.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

What you need to know

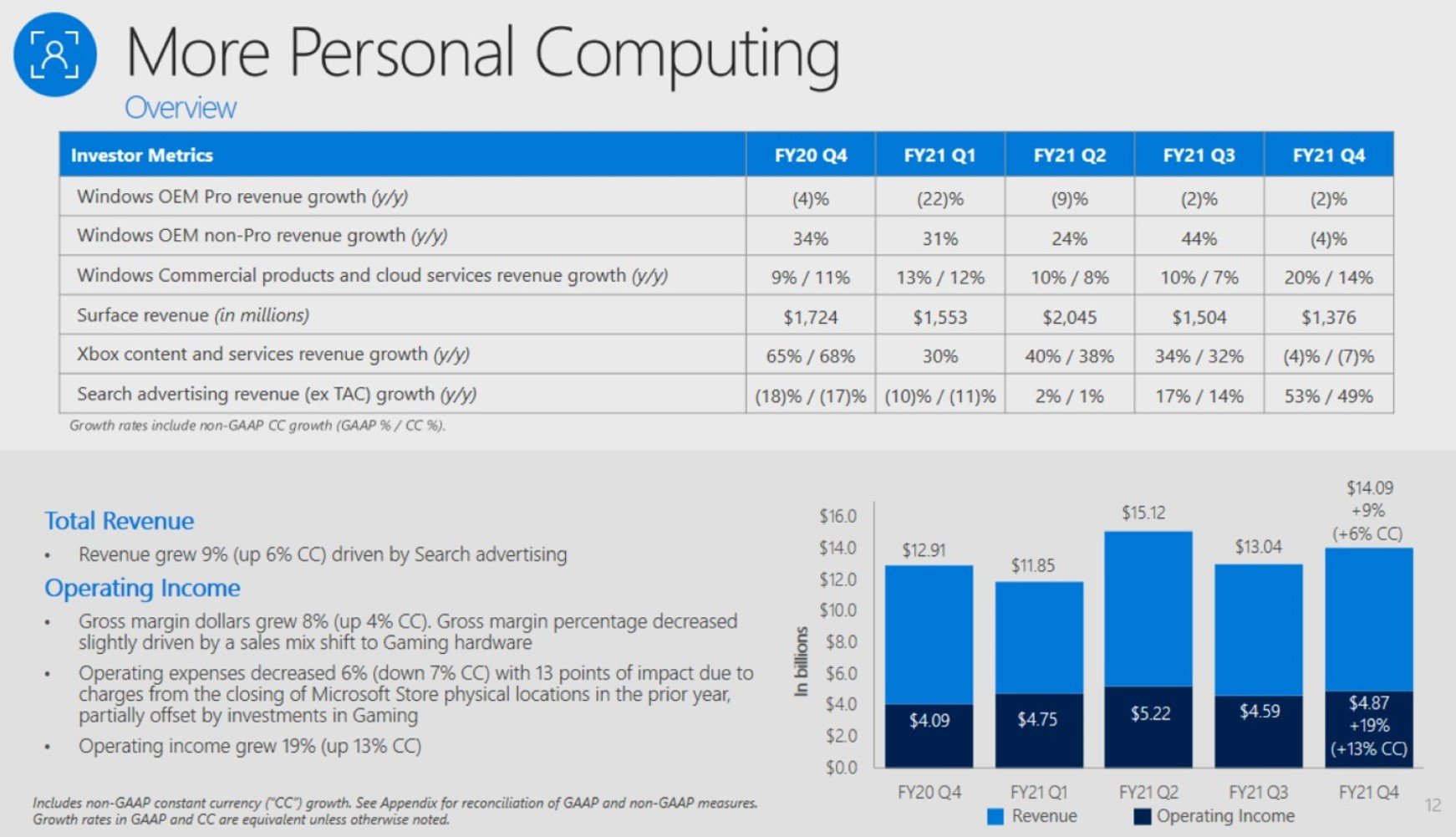

- Surface revenue is down 20% due to expected ongoing supply constraints.

- Microsoft pulled in $1.37 billion in Surface revenue, down from $1.5 billion last quarter.

- Windows OEM non-Pro licenses declined by 4%, and Windows OEM Pro revenue declined by 2%.

- Microsoft beat overall Wall Street expectations again, bringing in $46.2 billion in total revenue.

Update: In the investor call, Microsoft gave guidance for next quarter's More Personal Computing (MPC) division. Surface is expected to see reduced revenue in the "low teens," as Microsoft contends with ongoing supply chain issues. Xbox sales to grow in "low single digits," gaming services growth of "low double digits", search revenue up in the high 30s, and overall MPC revenue to fall between $12.4 and $12.8 billion, an increase from $11.8 billion YoY from FY21 Q1.

Microsoft's earnings report for the fourth quarter of its 2021 fiscal year has just come out, and the company is reporting $1.37 billion in revenue for the Surface division.

Overall revenue for the company was a staggering $46.2 billion. Wall Street expectations were for $44.10 billion in revenue, with Microsoft again blowing past those numbers – a trend Microsoft has been doing for years now.

Revenue in More Personal Computing, which includes Windows and Surface, was $14.1 billion and increased 9% (up 6% in constant currency). The overall increase is driven by Windows Commercial products (e.g. Microsoft 365) and cloud services, up 20% YoY.

Likewise, Bing search advertising revenue grew 53% on a "low prior year comparable, with improved customer advertising spend."

Compared to last year, Microsoft pulled in $1.74 billion in revenue for Surface and $1.5 billion in revenue from last quarter in April. The new numbers reflect a significant 20% drop in Surface revenue compared to this time in 2020.

However, none of this is a surprise. Microsoft anticipated a decline in Surface revenue due to those challenges, making today's news in line with investor expectations.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Microsoft noted back in April during its investor call that the current fourth quarter would see "execution challenges" in shipping Surface to consumers. That's industry jargon for the ongoing chip shortage affecting nearly all industries due to high demand and a short supply of critical components. Indeed, Microsoft noted in its FY21 Q4 results that "supply chain constraints" drove the decline.

The Windows OEM license news also reflects a more return-to-normal. This time last year, Microsoft saw a staggering 34% jump in Windows OEM non-Pro licenses, likely due to the growing pandemic and need for immediate new PCs to meet demand.

Like Surface revenue, Microsoft pins the decline in Windows OEM revenue on supply chain constraints as well as "a strong prior year comparable in OEM non-Pro" licenses.

The good news is that the need for Windows OEM licenses and even Surface hardware appears to be relatively high, but the supply is falling well short of demand. Many companies, including Intel, have noted things may not return to normal for chip supply until well into 2022.

Microsoft also saw strong demand, but a more return to normalcy for its gaming division driven by Xbox, where revenue is up 11% YoY.

Microsoft Surface: A light quarter

Microsoft didn't have too much in the way of new products over the spring and summer of 2021. The only new product launched was Surface Laptop 4, itself a minor iteration of last year's Surface Laptop 3.

The company, however, did refresh many of its accessories to meet the demand of the modern workforce. Refreshes to Surface Headphones 2+ and new headsets and speakers were all part of that push, which, while lower in revenue, is still vital to the bottom line.

Microsoft seems busy finishing up Windows 11, which saw a surprise announcement back in June. The company has received primarily favorable feedback from its next-gen OS, which is expected to launch later this year in October.

While Microsoft has not commented on future Surface hardware, the Surface Duo 2 and a new Surface Pro 8 are expected to be announced in the coming months. However, the ongoing chip shortage has likely pushed back additional Surface hardware releases, possibly until spring or fall 2022.

Daniel Rubino is the Editor-in-Chief of Windows Central. He is also the head reviewer, podcast co-host, and lead analyst. He has been covering Microsoft since 2007, when this site was called WMExperts (and later Windows Phone Central). His interests include Windows, laptops, next-gen computing, and wearable tech. He has reviewed laptops for over 10 years and is particularly fond of Qualcomm processors, new form factors, and thin-and-light PCs. Before all this tech stuff, he worked on a Ph.D. in linguistics studying brain and syntax, performed polysomnographs in NYC, and was a motion-picture operator for 17 years.