Microsoft stock continues downward trend, dropping 10% — ballooning infrastructure CAPEX, shrinking AI hype, and Google blamed

Microsoft execs have offloaded millions of dollars worth of stock over the past quarter, as the firm's outlook (no pun intended) looks murky.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

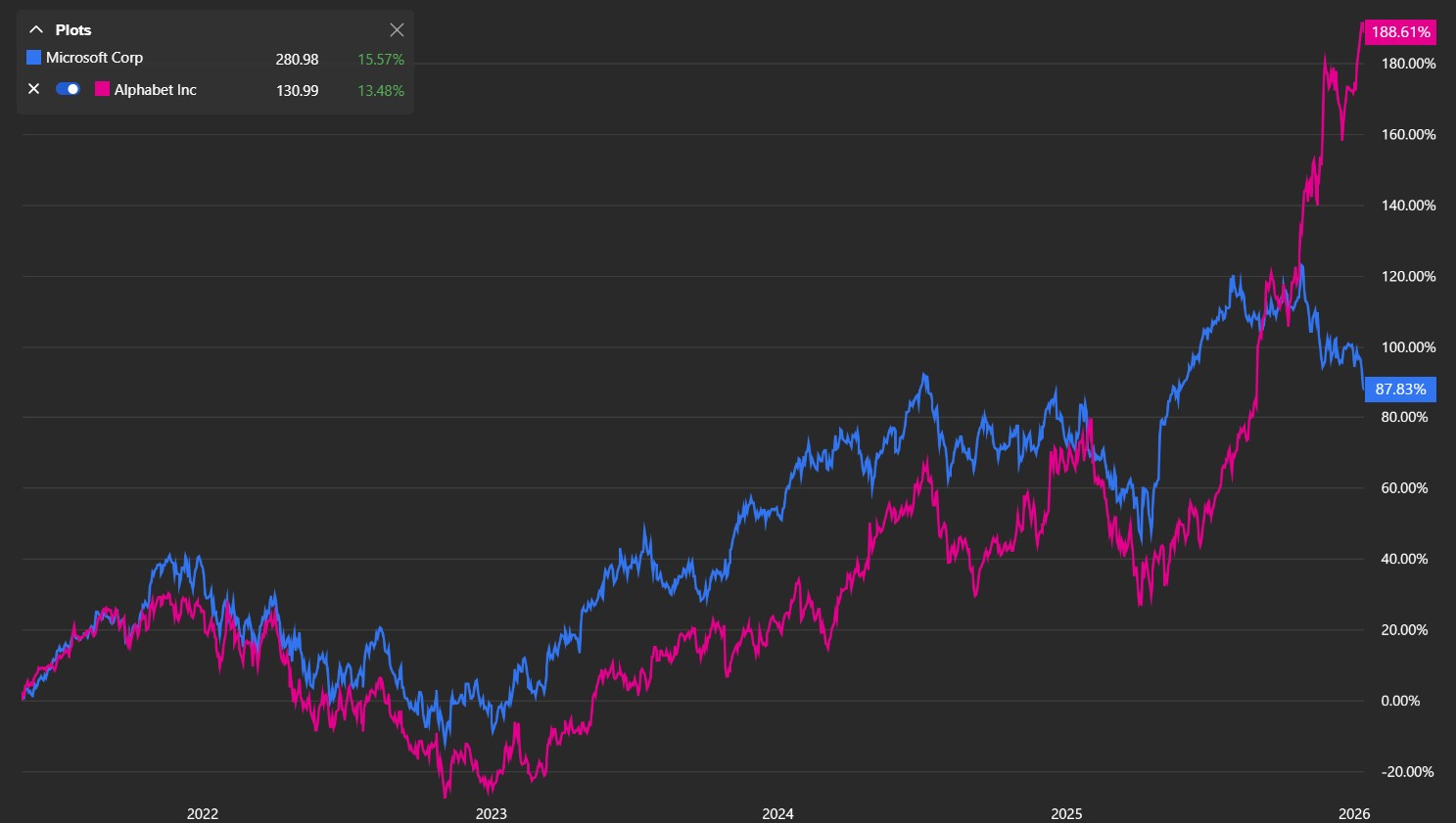

Microsoft's stock has suffered a bit of a battering over the past few months, largely wiping out all gains it made the six months prior.

As of writing, Microsoft's stock is down around 10% over the past three months, as executives like CEO Satya Nadella, President Brad Smith, and CCO Judson Althoff unload tens of millions of dollars of shares.

Although the sales are routine and not exactly indicative of a wider shift, the near constant decline since June paints a picture of broader headwinds Microsoft and other tech companies are facing as the AI hype train cools and reality begins to set in.

Microsoft's capital expenditure (capex) for AI data center infrastructure increasingly seems to be a sore point for investors. Microsoft's costs in this area have spiralled, hitting a record-breaking $35 billion for its Q1 2026. Investors are not only concerned that returns on this infrastructure spend may elude Redmond for months if not years to come, but there are fresh regulatory concerns adding jitters into the mix.

Yesterday, Microsoft President Brad Smith revealed a five-point "Community First" AI data center plan, which was met with mockery and scepticism online. Not long after that, United States President Donald Trump made comments about how data centers are hurting communities and electricity prices — given that affordability is a major voter issue heading towards the U.S. electoral mid-terms.

Trump states on the Truth Social media platform that, [sic] "my Administration is working with major American Technology Companies to secure their commitment to the American People, and we will have much to announce in the coming weeks." He continued, "First up is Microsoft, who my team has been working with, and which will make major changes beginning this week to ensure that Americans don’t “pick up the tab” for their POWER consumption, in the form of paying higher Utility bills."

The comments alone sparked a 4% dip in Microsoft's shares, as negativity and the societal costs of AI infrastructure spend start to mount. NVIDIA's CEO said that "doomer" attitudes around AI were hurting investments into the tech, and that sentiment could be starting to go mainstream.

All the latest news, reviews, and guides for Windows and Xbox diehards.

"Microslop" began trending over the past few months, as the firm's focus on AI has begun hurting the quality of its core products. There have also been several high-profile stories regarding Microsoft Copilot hallucinations, including a row in the United Kingdom after Copilot inferences were used to justify banning Israeli fans from a football event.

Another angle for the stock rout revolves around Google, whose Gemini AI models have become increasingly capable over the past few months. The latest Gemini Pro and Nano Banana Pro models have leapfrogged Microsoft-backed ChatGPT in recent months, leading to a huge surge of interest in the Alphabet company's stock.

Google also controls the full stack, with Tensor-based servers, AI defaults on both Apple iOS and Google's Android, and potentially Windows as well via its Chrome dominance. Microsoft Copilot by comparison has seen anaemic adoption among consumers, and the Azure-powered ChatGPT's relevance seems to be waning.

Microsoft has a key advantage with Copilot when it comes to heavily regulated corporate environments, however. Its position with Microsoft 365 is second to none when it comes to national and inter-corporate regulatory compliance and security. Headlines about the tech's mis-use are unlikely to dents its adoption in the corporate or governmental space, many of which already leverage Microsoft 365 and other Azure platforms to organize their documents, systems, and employees.

The United Kingdom uses secure Copilot instances and agents at scale for reporting and data curation, for example, with automated agents performing menial and time-consuming tasks previously left to humans.

Google is unlikely to beat Microsoft when it comes to corporate applications of large language model AI tech, but concerns about returns, expense, regulation, and long-term viability remain at the forefront of many investor's minds.

Microsoft's stock is still up 7.5% for the past year, but even those gains could be wiped out if trends continue in this direction.

Google is winning owing to long-term planning over Microsoft's short-termism

Google's investments in server technology, Android, mobile hardware, and the web have given it an incredible position to dominate this space.

Microsoft is tying itself in knots trying to figure out how best to present artificial intelligence to its Windows user base. Microsoft also notoriously shelved its home-grown hardware infrastructure, with Windows Phone and Surface alike suffering from short-term thinking from the top down.

Analytically, it often feels like Microsoft is its own worse enemy. Every time they are on the edge of achieving truly great things, Satya Nadella's Microsoft seems to get cold feet — cutting and running at the last hurdle. The plan for a unified computing solution from the Windows 8 era, across Xbox gaming, Surface laptops, and Windows Phone devices would've been the ideal platform to unify and proliferate this type of experience with consumers. Nadella couldn't stay the course, though, for whatever reason.

RELATED: Why Microsoft won't be the one to mainstream consumer AI

Microsoft under Satya Nadella has, of course, been a huge success story. Microsoft has enjoyed a top 5 stock price position for most of his tenure, and the early investments in OpenAI have been called some of the best deals in investment history. But Microsoft's issues present themselves when it comes to actually nurturing their investments.

There's a huge array of products and services that ended up becoming abandoned as Microsoft's interests turn on a dime, despite initial explosions in popularity. Microsoft acquired popular apps and services like Skype, Mixer, SwiftKey and Accompli, and managed to either ruin them or abandon them, rather than improve them. Promising products that would've had relevance in the AI age, like the Microsoft Band, Windows 10 Mobile, or even HoloLens, were shuttered rather than developed.

Now increasingly, Microsoft's partnership with OpenAI is starting to look like some of those other acquisitional quagmires, albeit on a much more massive, potentially catastrophic scale.

I would like to see Microsoft return to bold innovation, hardware endpoints, and consumer products — but above all, quality. Which under CEO Satya Nadella, has taken a turn for the worst.

Will Microsoft move forward with its plans to evolve Windows into an agentic OS despite backlash from users? Share your thoughts in the comments.

Follow Windows Central on Google News to keep our latest news, insights, and features at the top of your feeds!

Jez Corden is the Executive Editor at Windows Central, focusing primarily on all things Xbox and gaming. Jez is known for breaking exclusive news and analysis as relates to the Microsoft ecosystem — while being powered by tea. Follow on X.com/JezCorden and tune in to the XB2 Podcast, all about, you guessed it, Xbox!

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.