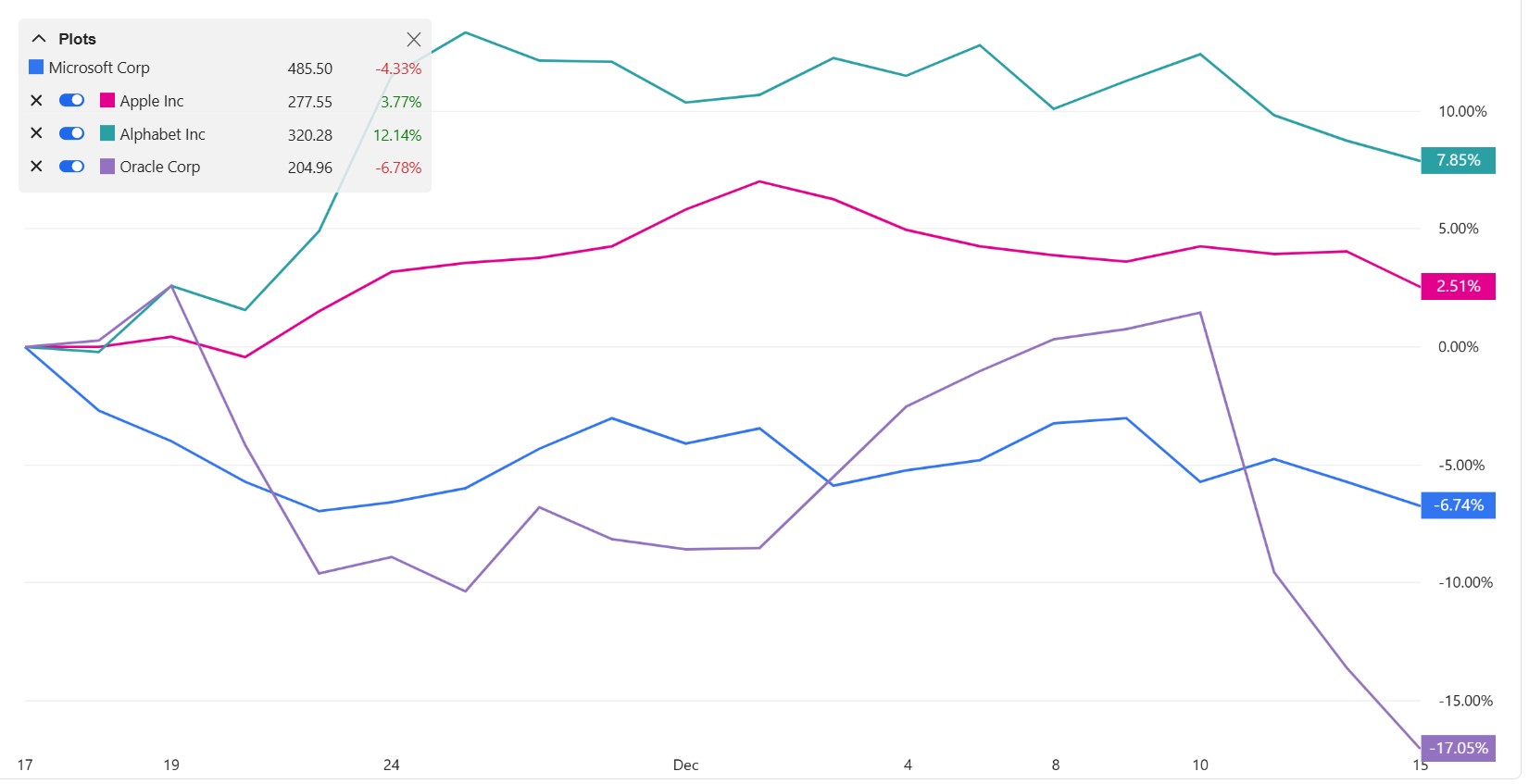

Microsoft shares have dropped 5% in just two weeks as Google leapfrogs into third place, signaling a momentum shift in AI

Microsoft’s stumble is Google’s opening.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

Microsoft's share price took a battering over the past couple of weeks, what's going on?

Yesterday, someone linked me an AI-generated article alleging that Xbox's near-total absence from The Game Awards was to blame for a multi-billion decreases in its stock price. It was a cute idea, but simply not based in reality.

Microsoft's share price has slid around 7% in the past month, although it's still up 5% for the year in total, and up over 120% across the past five years. One of the big success stories for CEO Satya Nadella has been a reignition of Microsoft's stock market performance, but the stock is behaving a little odd over the past few weeks.

No, investors do not care that Xbox wasn't present at The Game Awards, especially not to the tune of over $170 billion in lost market capitalization — likely worth more than all of Xbox itself. Microsoft's share price has slid owing to a conflux of various AI-related reasons, both directly and indirectly, as investors get nervous about Microsoft's position.

Google is up, Microsoft is down

Microsoft's stock price slide is a combination of various factors, all directly and indirectly related to its position in artificial intelligence.

AI is driving the stock market right now, with companies like NVIDIA, Meta, and Oracle all dominating the space. Microsoft's own position, partnered with OpenAI, helped drive the firm to second place for global market capitalization, behind only NVIDIA. NVIDIA's server tech is powering everything from cloud compute to AI workloads right now, and companies like Microsoft and Amazon are re-selling NVIDIA GPUs and other products so firms can build out their own AI aspirations.

Microsoft isn't really an innovator in the AI space, relying on OpenAI's models to deliver its products. One big fear investors have lately revolves around whether the frenzy to deliver AI will actually produce a return on investment. Companies like Oracle and Broadcom have seen large stock market slides recently, after their earnings and forecasts thoroughly underwhelmed Wall Street. Broadcom dropped by 11% — driven by the disappointment over its purported "backlog" of $73 billion worth of compute orders. Broadcom, Oracle, OpenAI, and various other companies have been relying on "commitments to buy" lately, but have been unable to actually deliver compute owing to a variety of issues.

All the latest news, reviews, and guides for Windows and Xbox diehards.

There are huge and increasing demands for computing power from various AI companies, particularly those that rely on NVIDIA's stack. Microsoft CEO Satya Nadella recently warned in an interview that he has GPUs sitting on the shelf because the electricity physically isn't available yet. The United States power grid literally can't meet demand for the hyperscalers, which is spooking investors into thinking we might have hit an upper limit in the near term for how fast server infrastructure brokers can grow.

Companies like Microsoft and Google have been aggressively researching efficiency to offset some of these bottle necks. OpenAI has also increased the efficiency of its models in a universe where compute isn't scaling fast enough to meet demand, but investors seem concerned that the business models associated with AI might never produce a return on investment.

Broadcom and Oracle both spooked investors with capital expenditure warnings, as firms race to meet the computational needs of companies like OpenAI and Anthropic. Oracle, which has become an AI-first company all up in recent years, missed both revenue and profit projections, and warned that its capex burn would be 2026 would be $15 billion higher than its prior projections. It also reported negative cash flow, as its AI business fails to actually generate tangible profits. Investors rewarded them with a sharp sell-off to the tune of around 11%.

Microsoft's diversified business insulates it to some degree from these types of spikes, but not completely. Investors are increasing re-evaluating AI infrastructure spend, as valuations spiral out of control that seems incongruent with reality.

For Microsoft in particular, the fact Google Gemini's latest Pro models beat OpenAI's in most, if not all benchmarks, increasingly paints Alphabet as a frontrunner. Google also controls more of the tech stack, with home-grown Tensor server infrastructure, eliminating some of the costs associated with working with companies like NVIDIA. Microsoft has also reportedly cut internal goals and forecasts, as consumers and companies alike seem unwilling to spend money on its AI products.

There's other factors at play, too. State attorney generals in the United States sent Microsoft and other AI players a letter, warning them to fix "delusional" hallucinations and sycophancy, after a string of high-profile "AI psychosis" cases where the tech fed dangerous ideations to vulnerable people. Regulation protects people (at least in theory), but is often thought to harm profitability (oh no!).

AI stocks might be coming back to Earth, but the tech is here to stay

It's easy to clown on Microsoft Copilot. Its lacklustre features in Notepad, MS Paint, Microsoft Photos, and other Microsoft products just screams of haphazardry and poor execution. The firm doesn't seem to know what role AI could, or should play within Windows 11 consumer-grade features and products, despite desires to turn Windows 12 into an agentic AI-first OS (much to the annoyance of users).

Where Copilot is winning seems to be within enterprise grade solutions. Creating regulatory-compliant AI solutions for law firms and financial service institutions seems to be forming a winning solution for Microsoft, where centralized and IT-monitored solutions shine for companies that are already embedded in Microsoft Azure. Github Copilot has also been something of a success story too, offering programmers a more accessible alternative to Anthropic's Claude.

Increasingly, though, investors think Google might emerge as the front runner for the tech and its implementation. Slow out of the gate, Google's early AI efforts simply served to hurt its own search engine dominance and make a mockery out of itself with notorious summary hallucinations and errors. A couple of years later, Google Gemini Pro and Nano Banana image generation tools are now largely superior to OpenAI, evaporating Microsoft's early advantages in a single month.

Google has now leapfrogged Microsoft in market capitalization value, as of writing, slipping up into third place, as Microsoft sinks to fourth. Apple has ironically strengthened its position by ditching its laughable home-grown AI attempts, and opting to leverage Google's instead for its own Siri "Copilot" assistant and other AI features. Microsoft's own solutions have effectively been squeezed out of phones, potentially forever.

Microsoft, without a phone platform to call its own, is once again forced to rely entirely on Windows and enterprise to push its own AI products. Windows remains a dominant fixture in computing, but hate of Windows 11 has gone fully mainstream. More and more companies and even governments are embracing open source solutions, Linux, and other alternatives over Microsoft's own. Apple and Google have effectively locked Microsoft out of mobile computing entirely, flanked by CEO Satya Nadella's short-sighted decision to stop investing in Windows Phone.

A ~5% slide isn't anything too shocking, but like Time Magazine's snub of Microsoft — it's symbolic of changing winds on the frontiers of AI. Microsoft dominated the conversation for the past two years, but once again, its old rival Google seems poised to take pole position.

Follow Windows Central on Google News to keep our latest news, insights, and features at the top of your feeds!

Jez Corden is the Executive Editor at Windows Central, focusing primarily on all things Xbox and gaming. Jez is known for breaking exclusive news and analysis as relates to the Microsoft ecosystem — while being powered by tea. Follow on X.com/JezCorden and tune in to the XB2 Podcast, all about, you guessed it, Xbox!

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.