Microsoft loses a massive $440 billion in market cap as shares tank — investors get increasingly sceptical of its AI strategy

Microsoft investors didn't enjoy the company's FY26 Q2 report, as fears of its AI strategy begin to unravel into despair.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

Microsoft's stock just achieved an unsettling milestone.

Microsoft can now claim to have experienced the second-largest single day stock decline in history, wiping an absurd $440 billion in market value from the tech giant. The drop is only behind that of NVIDIA from last year, who experienced a similarly deep shock when China's efficient DeepSeek AI model implied that you didn't need as much NVIDIA tech to have a capable chatbot as previously thought.

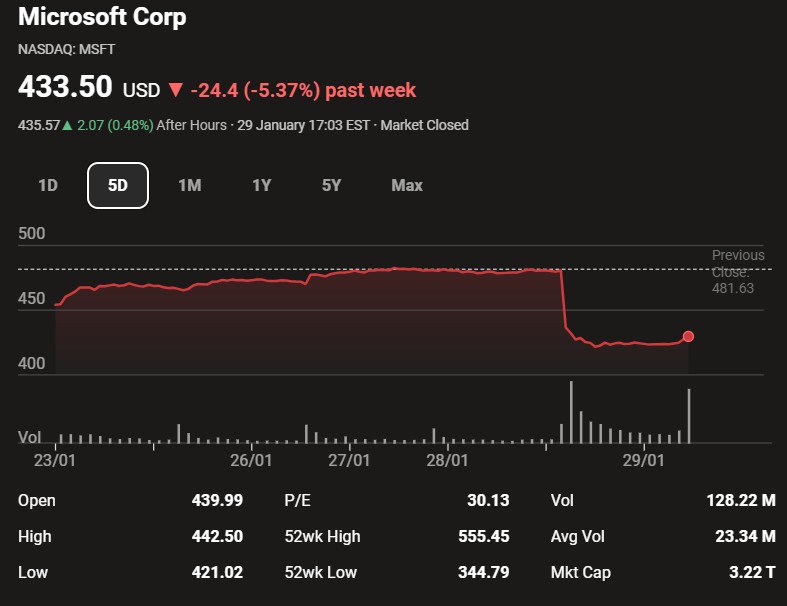

Microsoft's share price dropped a whopping 5.37% today, and is down almost 14% for the month of January 2026 so far. The stock continues its downward trajectory, which largely began this past summer.

Now, year to date, Microsoft's stock is down overall 2%, wiping out all of the AI-related gains it made over the past year.

Microsoft's stock rout revolves around a similar theme: it's all about artificial intelligence. Here's what's going on.

Speaking yesterday to investors, Microsoft announced what, on paper, seemed like pretty solid results. Call of Duty is having an off-year, which drove Xbox down by 9% and Microsoft's entire computing segment down by 3%, reflecting just how big Call of Duty is when it comes to Microsoft's consumer segment. One off year can drag down the whole division — despite the fact it said Xbox PC and Xbox Cloud Gaming were seeing record usage.

Investors don't care too much about what Microsoft is doing with Windows and Xbox, though. So no, Call of Duty having an off year, or even Windows 11 seeing a noticeable decline in quality, isn't really impacting the share price. Xbox could be up 50% year-over-year, and it wouldn't have a meaningful impact on the stock. In fact, we saw this when Microsoft started factoring in Activision-Blizzard into Xbox's earnings.

All the latest news, reviews, and guides for Windows and Xbox diehards.

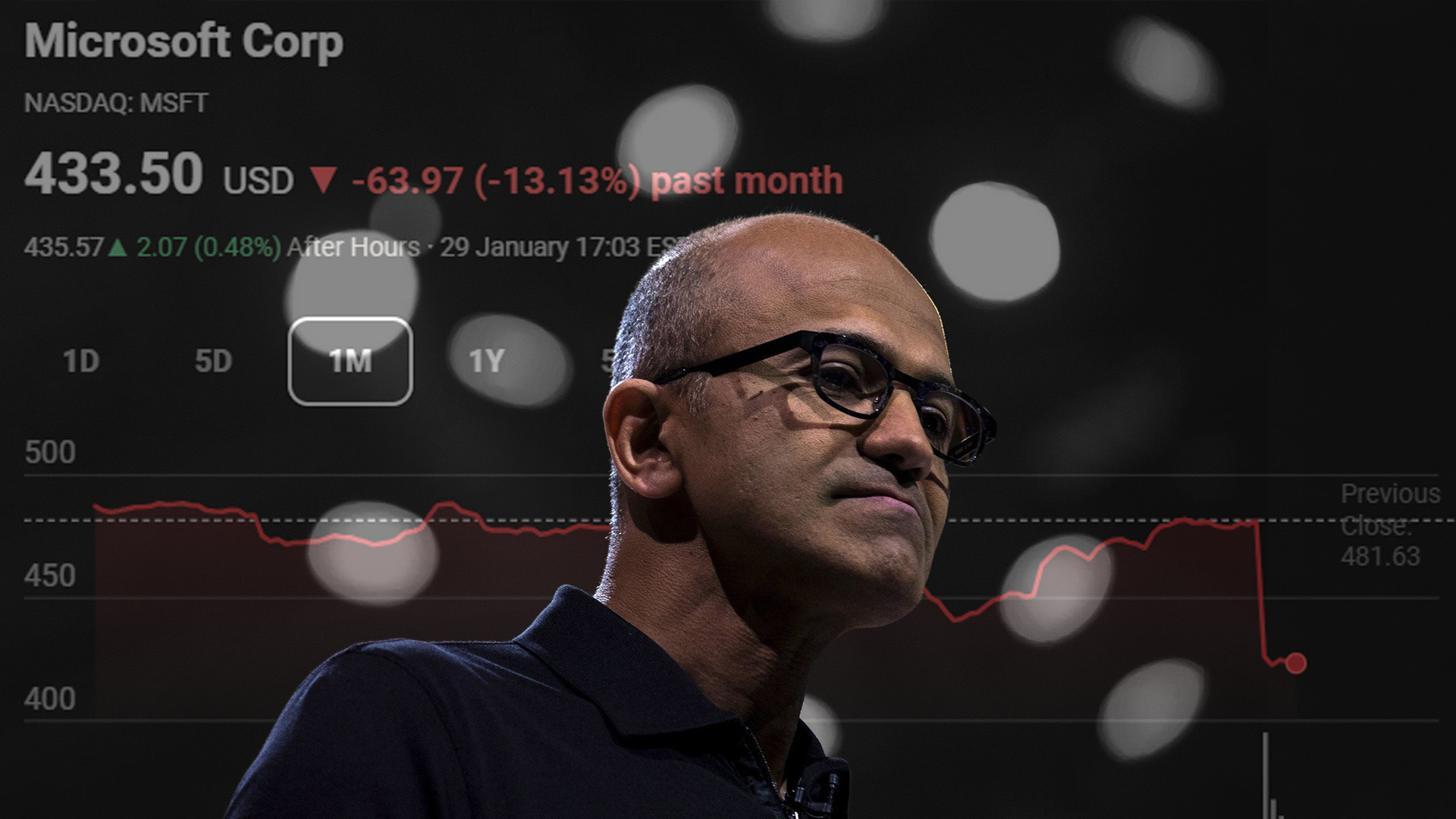

The stock revolves entirely around Azure; Microsoft's biggest division by far. But, investors are growing increasingly weary about Satya Nadella's strategy surrounding Azure, and artificial intelligence in particular.

Azure grew by 39%, which sounds fantastic, but Wall Street apparently wanted more. Investors were also unimpressed by the future-facing statement of a further 37% growth. Cloud revenue surpassed $50 billion, atop a huge $81.3 billion annual revenue, up 17% year-over-year. Operating income was up 21% year-over-year, with a net of $38.5 billion. Microsoft 365 Copilot was up 160% year-over-year. Github Copilot was up 75% year-over-year. Shareholder returns were up 32% year-over-year too.

What more could investors possibly want?! You might ask. Well, the explanation doesn't make a lot of sense to me either, as a lowly pauper, but all of this still isn't enough.

The real reason the stock is down is because the growth doesn't reflect the capital expenditure Microsoft has committed to artificial intelligence and infrastructure surrounding it. Construction, in essence, and the risks therein.

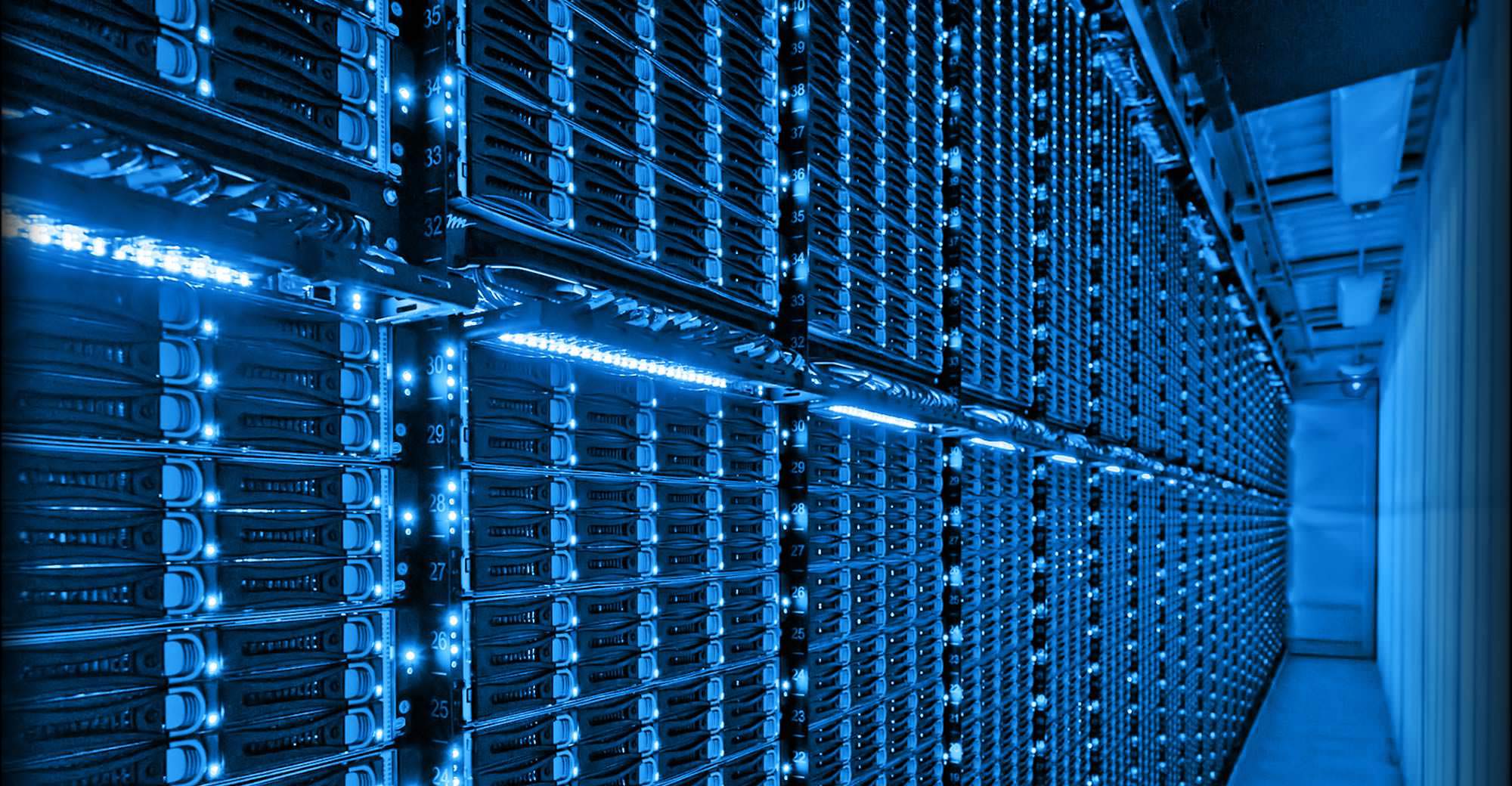

Capex jumped to almost $40 billion for the quarter, up around 70% year-over-year depending on the analyst. Tons of this money has been poured into NVIDIA GPUs, which might have a decent shelf life in your gaming PC, but depreciate in value incredibly quickly as part of a huge data center cluster. Investors are basically concerned that Microsoft won't see any meaningful returns on this silicon investiture before everything needs to be upgraded or replaced.

Investors are also spooked by Microsoft's over-reliance on OpenAI, which has become a notoriously vast industrial-scale cash-burning machine. OpenAI is reportedly seeking tens of billions in further investments, looking to NVIDIA, Amazon, and Microsoft, to keep it from imploding.

Increasingly, investors are simply asking: where are the returns on all of this spend?

📉 So in summary:

- No, Call of Duty having an off year didn't wipe out multiple-times its entire value in Microsoft stock. Obviously, hopefully.

- Investors mainly care about Azure and AI, and are growing uneasy about its strategy.

- Microsoft's AI and cloud revenue is up massively, but it's not up at the kind of pace investors would like given how much its spending on data center infrastructure.

- Investors worry that Microsoft won't see real returns on its GPU investments before the chips need to be deprecated or replaced.

- Data centers require permits, construction fees, electricity, cooling, on-going maintenance, and piles of custom silicon. Microsoft's capex is growing at an alarming rate, and could burden margins if profitability doesn't arrive more quickly.

- Microsoft is aggressively betting on a future where AI becomes far far more useful than it is today. The pay off could be unlike anything we've ever seen, but investors are sceptical that the applications for Microsoft's AI tech will actually scale to that degree.

- Investors worry that the firm's dependence on cash-burning OpenAI and ChatGPT is burdensome, too.

I'm not entirely sure what Microsoft is hoping to accomplish from its AI spend. It says that it has more demand for AI-related compute than it can supply today, to justify the capital expenditure and infrastructure growth, but are the ways AI is being used today represenative of something that can deliver serious revenue?

The vast majority of people using AI today are doing so for free. OpenAI is experimenting with advertisements and other paid tools in attempts to drive up its revenues. Microsoft Copilot is relatively poor in quality compared to competitors, and has increasingly become an example of how not to do AI.

Google's share price is outpacing Microsoft's because, on paper, it seems to have better economics. Google is showing discipline with its capital expenditure and infrastructural commitments, growing at smaller volumes but in what investors feel is more measured. Microsoft's strategy is far more aggressive, and seems to revolve around futuristic sci-fi ideas of "artificial general intelligence" — akin to something you might see in a movie, rather than the memeslop generators they are today.

Which strategy will win out in the end? It remains to be seen, but structurally, Google's ownership of the entire stack looks, on paper, like more effective and more efficient than Microsoft's "bet on OpenAI and Sam Altman" strategy, who increasingly looks like a bit like the snake oil salesman from the Fallout TV show.

Follow Windows Central on Google News to keep our latest news, insights, and features at the top of your feeds!

Jez Corden is the Executive Editor at Windows Central, focusing primarily on all things Xbox and gaming. Jez is known for breaking exclusive news and analysis as relates to the Microsoft ecosystem — while being powered by tea. Follow on X.com/JezCorden and tune in to the XB2 Podcast, all about, you guessed it, Xbox!

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.