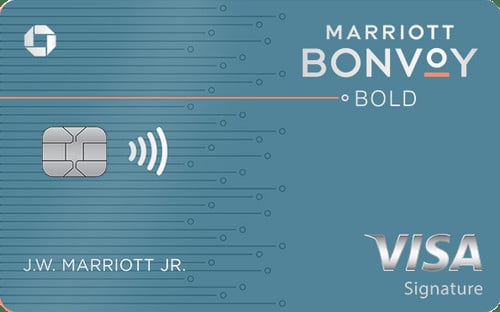

Marriott launches Bonvoy Bold Card with no annual fee and a 50k bonus point offer

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

Heads up! We share savvy shopping and personal finance tips to put extra cash in your wallet. Windows Central may receive a commission from The Points Guy Affiliate Network. Please note that the offers mentioned below are subject to change at any time and some may no longer be available.

If you're a frequent traveler and have been thinking about getting into a Marriott branded credit card but hesitant because of the annual fees that have historically come standard with their cards, today is a good day. Marriott has just launched the new Bonvoy Bold Credit Card, Marriott's first Bonvoy branded card without annual fees.

The new card comes with a pretty solid introductory offer of 50,000 bonus points after you spend $2,000 on purchases in your first 3 months from your account opening. The Points Guy reports the value of this pile of points at about $400, making it a respectable offer for a card that doesn't have an annual fee.

The card features a pretty standard 1, 2, 3 rewards program: 3X points for every $1 spent at 6,900+ participating Marriott Bonvoy hotels, 2X points per $1 spent on other travel purchases (from airfare to taxis and trains), and 1X points per $1 spent on all other purchases. While this doesn't match up to the higher rewards rates of the other Marriott Bonvoy credit cards, its an expected concession when enjoying no annual fees.

Other benefits of the card include 15 Elite Night Credits annually, qualifying you for Silver Elite Status, which is Marriott's gateway to extra perks like a dedicated phone line for booking reservations and late checkouts. There are also no foreign transaction fees that Chase charges for the card, meaning you can travel internationally fee-free (at least as much as your card is concerned).

Like any good travel card, the Marriott Bonvoy Bold Credit Card also includes tons of extra travel protection perks like baggage delay insurance, lost luggage reimbursement, trip delay reimbursement, purchase protection, and Visa concierge service.

While the card does not earn as many rewards as its big brother, the Marriott Bonvoy Boundless Card, you get a decent amount of the rewards and the benefits without the annual fee, all with an enticing introductory offer.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Earn 50,000 Bonus Points after you spend $2,000 on purchases in the first 3 months from account opening. Earn 3X Bonvoy points per $1 spent at over 6,900 participating Marriott Bonvoy hotels. 2X Bonvoy points for every $1 spent on other travel purchases (from airfare to taxis and trains) and 1X point on all other purchases. 15 Elite Night Credits each calendar year. No foreign transaction fees.

Joe is a Former Contributor for Windows Central.